Key events Show key events only Please turn on JavaScript to use this feature

Burberry to cut 1,700 jobs worldwide

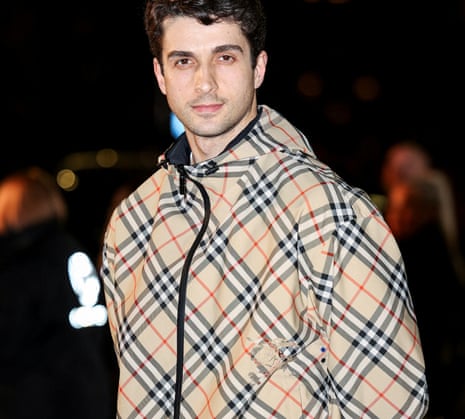

Burberry said it could cut 1,700 jobs worldwide by 2027, as the struggling UK fashion brand grapples with a downturn in luxury spending that pushed it into the red.

The company, known for its signature trench coats and beige, black, red, and white check, reported a pre-tax loss of £66m for the year to 29 March against a profit of £383m the year before. Revenues slumped by 15% to £2.5bn at constant exchange rates.

As part of its turnaround plan, Burberry is slashing a further £60m costs, as it aims for total cost savings of £100m a year. This will affect 1,700 jobs around its global offices. Burberry employed around 9,300 people around the world last year.

The company hired Joshua Schulman, the former boss of the US fashion brands Michael Kors and Coach, as chief executive last July in a bid to revive its fortunes.

Introduction: China criticises UK-US trade deal; Aviva's £3.7bn acquisition of Direct Line faces competition inquiry

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

China has reportedly taken aim at last week’s trade deal between the UK and US that could be used to squeeze Chinese products out of Britain’s supply chains.

The deal - the first struck by Donald Trump’s administration since announcing sweeping tariffs last month - was announced on Thursday, and includes strict security requirements for Britain’s steel and pharmaceutical industries. It could make it harder for London to rebuild relations with Beijing.

Beijing said it is a “basic principle” that agreements between countries should not target other nations. China’s foreign ministry told the Financial Times:

Co-operation between states should not be conducted against or to the detriment of the interests of third parties.

Britain’s competition watchdog is reviewing Aviva’s proposed £3.7bn acquisition of its smaller insurance rival Direct Line to see whether it poses any competition concerns.

The deal would combine the companies’ UK insurance operations – covering a wide range of products such as car and home insurance.

The Competition and Markets Authority (CMA) is assessing whether the deal may lead to a “realistic prospect of a substantial lessening of competition”. It has 40 days to review the deal.

If it finds no competition concerns following its “phase 1 review”, it will clear the transaction. If the CMA finds concerns and considers that the merger needs a full phase 2 investigation, the two companies will have an opportunity to propose remedies to address such concerns.

The Agenda

-

12.00pm BST: US MBA mortgage applications

-

3.30pm BST US EIA crude oil stocks

4 hours ago

5

4 hours ago

5