As Britons braced for freezing wintry weather in early months of the 2022 energy cost crisis, the country’s fourth largest gas and electricity supplier urged struggling households to try “doing a few star jumps” to keep warm.

This poorly judged suggestion, alongside others such as “having a cuddle with your pets”, was branded insulting and offensive by consumer groups. For many, the gaffe marked the beginning of Ovo Energy’s precipitous fall from grace.

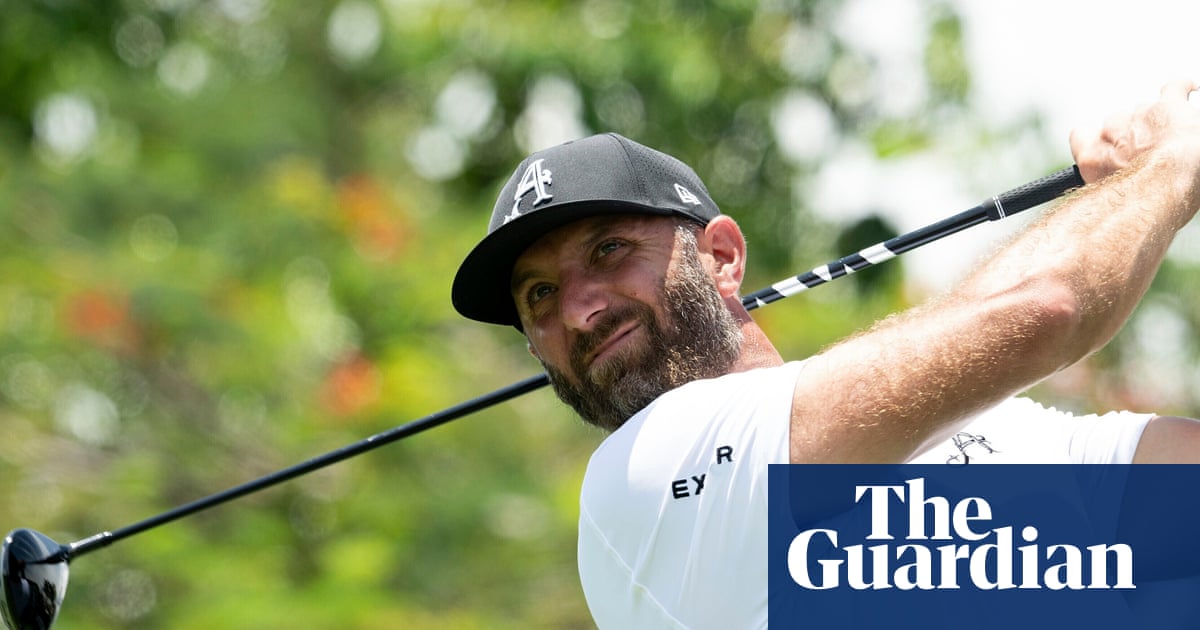

With one questionable blogpost the company founded by Stephen Fitzpatrick in 2009 as a green disrupter to the legacy “big six” incumbents had come full circle; from an outspoken critic of poor customer service to appearing out of touch and insensitive to the struggle of its customers.

At the time, Ovo had recently completed the acquisition of SSE’s energy supply business, catapulting it into the same tier as the domestic power giants Fitzpatrick had criticised for years – and making him one of Britain’s richest men.

Now the supplier is warning in its latest account of doubts over its financial future, having failed to meet the regulator’s resilience standards put in place after rocketing wholesale prices in the energy crisis caused scores of providers to collapse.

It is poised to cut about 200 jobs in order to save millions of pounds in costs. The redundancies are part of plan submitted to the industry regulator, Ofgem, to prove that it complies with new financial standards.

An Ovo spokesperson said: “We’re making changes that bring us closer to customers and sharpen our focus as an energy retailer. Our actions will help us build a stronger, more resilient business that better serves our customers and meets regulatory requirements. Where roles are affected, we will consult fully and support colleagues throughout.”

Meanwhile, a revolving door of executives has struggled to raise fresh funds from investors to help it meet the new requirements.

Earlier this month David Buttress, the former Just Eat chief, stepped down as Ovo chief executive after just 18 months, as did the company’s chief financial officer, James Davies, who was hired to the job a little over a year ago from Monzo.

In their place, Fitzpatrick is expected to install successors with a longstanding loyalty to the supplier. Chris Houghton, a former chief executive, is returning to the role to succeed Buttress, while Davies is expected to be replaced by Simon Todd, his deputy and a longstanding Ovo executive.

The executive shake-up emerged just months after the former Sainsbury’s chief executive Justin King was replaced on the board by the ex-Virgin Money boss Dame Jayne-Anne Gadhia, and comes as the company tries to raise £300m to shore up its finances.

Ovo is under pressure to raise the funds to satisfy the regulator that it is financially resilient enough to operate in the market and also to replace one of its longest-standing shareholders, Mayfair Equity Partners, which is understood to be hoping to offload its 30% stake.

Last month Sky reported that the Norwegian investment group Verdane had withdrawn from talks with Ovo over a potential investment in the business. The buyout company Permira was also reported to have backed away from talks after weeks of studying the terms of a potential deal.

This came after Iberdrola, the owner of Scottish Power, is understood to have held tentative discussions about a possible tie-up with Ovo, however, no deal was reached. Ovo has even engaged advisers at Arma Partners to explore the sale of a stake in Kaluza, its software arm.

But despite its financial woes and the ongoing high bills its customers face – Ofgem’s price cap stubbornly remains about 50% higher than before Russia’s invasion of Ukraine sent energy markets soaring – Ovo has continued to pay out millions every year to a company owned by Fitzpatrick, who is now worth an estimated £3bn.

Each year since 2014 the supplier has paid millions to Imagination Industries for the right to use the Ovo brand, in a similar arrangement to how Richard Branson’s businesses paid to use the Virgin name.

The company sits within a sprawling empire controlled by Fitzpatrick, including the flying taxi firm Vertical Aerospace, Kaluza and London’s Kensington Roof Gardens. A spokesperson for Ovo Energy did not respond when asked how the royalties due to Imagination Industries were calculated.

after newsletter promotion

Ovo’s accounts show that the royalty fees payable were typically between £2.5m to £7m a year – but these sums climbed during the height of the energy crisis to £24m and £40m in 2022 and 2023 respectively.

In total, the payable royalties outlined in Ovo’s financial reports total £122m. The actual amounts paid by Ovo have not been confirmed. Fitzpatrick agreed to sell Ovo Energy its own brand licence in exchange for shares worth £150m last year after discussions with the regulator. As part of the deal the £40m payable in 2023 was waived. This suggests that the royalty scheme could have generated over £272m of value for Fitzpatrick, almost the same amount he is struggling to raise from investors.

Two reasons emerge when trying to understand why the one-time wunderkind of Britain’s energy market is facing an uphill battle for fresh investment.

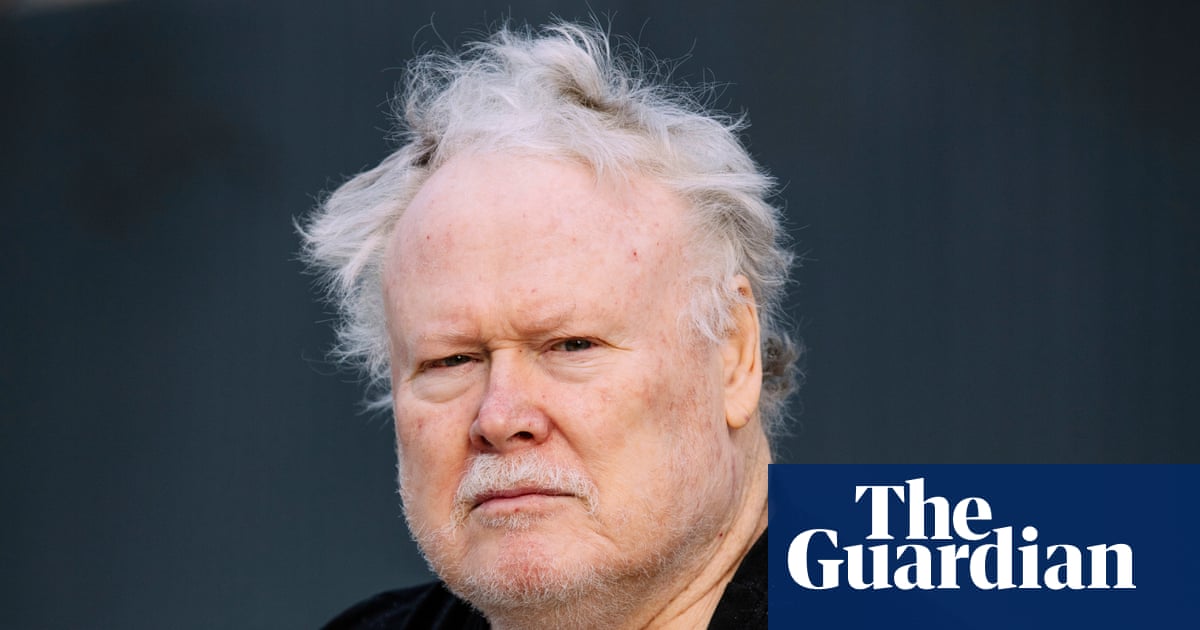

The first is that the perennial challenge of turning a profit in a market built on low-single digit margins has become even greater as political pressure to keep bills down has grown. Pouring investment into supplying household gas and electricity was inherently more risky than investing in other areas of the energy industry, according to Martin Young, a veteran industry analyst.

“Energy suppliers can easily find themselves in the crosshairs of politicians who are under pressure to bring energy bills down, but they have none of the regulatory certainty that you might find when investing in energy networks or power cables, for example,” Young said.

The regulator’s tougher stance on suppliers’ finances has been identified as a second key reason investors are wary of the sector. Ofgem’s minimum “capital targets” for energy providers, which came into force earlier this year, require suppliers to hold £115 in reserve for every customer they serve to protect against a repeat of the swathe of failures in 2021-22.

The arrangement has proved controversial. Ovo is one of the companies that has argued that the requirement to hold “dead capital” as part of its financial resilience rules was putting off investors and should be reconsidered.

“Ofgem panicked, put in place a kneejerk reaction and has failed to course correct,” a senior energy industry source told the Guardian. “Ovo is a profitable business, which survived a one-in-30-year crisis. They clearly have some financial resilience. There’s a growing sense that Ofgem should be thinking of a new way to measure financial resilience rather than creating ‘dead capital’ within a business.”

A spokesperson for Ofgem said: “The sector’s financial resilience has come a long way – from net negative assets during the crisis to £7.5bn adjusted net assets today. This protects consumers by acting as a buffer, while allowing suppliers to focus on driving up service standards and invest in new, innovative products.”

Ofgem said it would not be “appropriate or proportional” for the regulator to approve every financial decision a supplier made, “however, we expect them to act responsibly and in line with our rules, and consider their customers’ best interests”.

2 months ago

57

2 months ago

57