Key events Show key events only Please turn on JavaScript to use this feature

BoJ governor warns oil price changes could lift underlying inflation

Over in Tokyo, Japan’s central bank chief has warned that Middle East tensions could push up inflation, if oil remains high.

Speaking after the BoJ left interest rates on hold today, governor Kazuo Ueda told reporters:

“Coupled with already rising food prices, such moves in oil prices caused by tensions in Iran and Israel, if persist, could risk affecting inflation expectations and underlying inflation. So we must scrutinise developments carefully.”

Ueda also touched on trade war concerns, warning that manufacturers could be forced into cost-cutting if their profits were hit.

He also warned that the economic outlook was clouded by trade war worries, saying:

“Even if developments surrounding U.S. trade policy stabilise toward a certain direction, there’s very high uncertainty on how that could affect the economy….

For the time being, there is extremely high uncertainty over each country’s trade policy. As such, there is bigger downside risk for both Japan’s economy and prices.”

The pan-European Stoxx 600 index has fallen to a three week low this morning.

It’s down 0.9% today, with all the major European indices in the red.

European markets opens lower

European stock markets have opened in the red.

In London, the FTSE 100 index of blue-chip shares has dropped by 45 points, or 0.5%, to 8830 points.

Germany’s DAX dropped almost 1%.

Traders will be watching the Middle East, after US president Donald Trump told Iranians to “immediately evacuate” the capital.

In a post on his Truth Social site, Trump says:

Iran should have signed the “deal” I told them to sign. What a shame, and waste of human life. Simply stated, IRAN CAN NOT HAVE A NUCLEAR WEAPON. I said it over and over again! Everyone should immediately evacuate Tehran!

Jim Reid, market strategist at Deutsche Bank, says investors are in “a bit of a limbo” as to whether anything substantive came out of the G7 summit before Trump’s early departure from the gatherering of world leaders.

Reid adds:

There are still big questions as to whether Israel would be receptive to a ceasefire, given that it is seeking to destroy Iran’s nuclear program. Moreover, the public rhetoric hasn’t leant that way either, and Iran’s Mehr News Agency cited a senior security official saying that it is prepared to deliver a “major blow” to Israel after its strikes. So there is maybe diplomatic movement behind the scenes but not yet in the open.

The oil price has dipped slightly this morning, as the Israel-Iran conflict continues to drive markets.

Brent crude has dropped by 0.75% to $72.73 per barrel.

That wipes out some of the oil price’s 7% surge on Friday; it dropped by 1.35% on Monday.

Introduction: Fuel tanker rates surge as Middle East crisis worries markets

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

The Israel-Iran conflict is pushing up the costs of chartering oil tankers from the Middle East, as geopolitical fears weigh on markets again.

Tanker rates for vessels carrying refined oil products from the Middle East have surged in the last few days, amid concern that travelling through the Strait of Hormuz is now more risky.

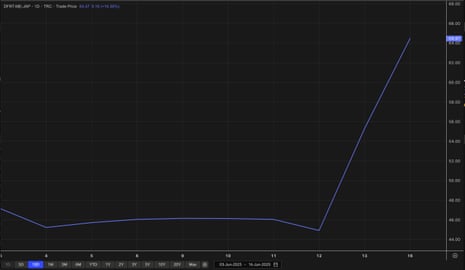

The cost to ship fuels from the Middle East to East Asia climbed almost 20% in three sessions to Monday, according to data from the Baltic Exchange.

Bloomberg, which reported the data, explains:

Benchmark rates for a medium-sized vessel carrying refined oil product from the Middle East to Japan, known as TC1, rose to 136 Worldscale points on Monday from 114 on Thursday. Costs for smaller vessels doing the same route, or TC5, advanced to 167 points, from 139 two sessions prior.

The corresponding level for mid-sized tankers carrying fuels from the Persian Gulf to East Africa, or the TC17 route, meanwhile, was at 287 Worldscale points on Monday, against 202 two sessions ago.

Worldscale points are a percentage of an underlying flat rate, which is set for each major route at the start of the year.

Tanker rates for vessels carrying refined oil products from the Middle East have surged in recent days, as the exchange of fire between Israel and Iran puts the flow of goods in the Hormuz Strait in the spotlight https://t.co/cPqG5QZo2T

— Bloomberg (@business) June 17, 2025LSEG data shows that the global benchmark rate for a very large crude carrier moving oil from the Middle East Gulf to Japan rose over 20% on Friday after the tensions broke out, and gained another 16% on Monday.

Prices jumped amid worries that Iran could potentially target energy facilities or shipping routes, or even close the Strait of Hormuz, if the current conflict – which began on Friday morning when Israel attacked Iranian nuclear facilities and missile sites – escalates.

Lazard Geopolitical Advisory (LGA) has warned:

A temporary disruption of the Strait of Hormuz, a key transit chokepoint for 30% of seaborne oil and 20% of LNG, could push oil prices upwards of $120 per barrel and would likely require US direct involvement to secure safe passage for energy flows.

Even in the absence of a Strait closure, oil markets will see continued volatility as the risk of a disruption evolves.

Naval forces have warned that electronic interference with commercial ship navigation systems has surged in recent days around the Strait of Hormuz and the wider Gulf, which is having an impact on vessels sailing through the region.

Lloyd’s List Intelligence, which monitors maritime traffic, said that loadings of vessels in the Gulf continued over the weekend but tankers waiting to load in Iran were keeping a greater distance from the port.

Shares rallied yesterday in Europe, and in the US, following reports that Iran was seeking an end to hostilities and the resumption of talks over its nuclear programs.

But stocks are likely to fall back today, as hopes of peace talks fade, after Israel issued an evacuation order to residents of a large part of Tehran.

Donald Trump, who left the G7 leaders summit early last night, has denied that he cut short his appearance at the meeting to broker a truce between Israel and Iran.

The agenda

-

All day: Paris air show

-

9am BST: IEA monthly oil market report

-

9.45am BST: Bank of England financial policy committee member Randall Kroszner gives a speech

-

10am BST: ZEW survey of German economic sentiment

-

11am BST: Germany’s Bundesbank issues monthly report

-

1.30pm BST: US retail sales report for May

-

2.15pm BST: US industrial production data for May

3 months ago

67

3 months ago

67