Introduction: Gold climbs to new record high

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

Gold keeps climbing, driven by geopolitical jitters, expectations of interest rate cuts, and anxiety that financial markets could have risen too high.

The spot price of gold has hit $3,759 per ounce this morning, a new record. It has gained 9% so far this month, and a blistering 43% since the start of this year.

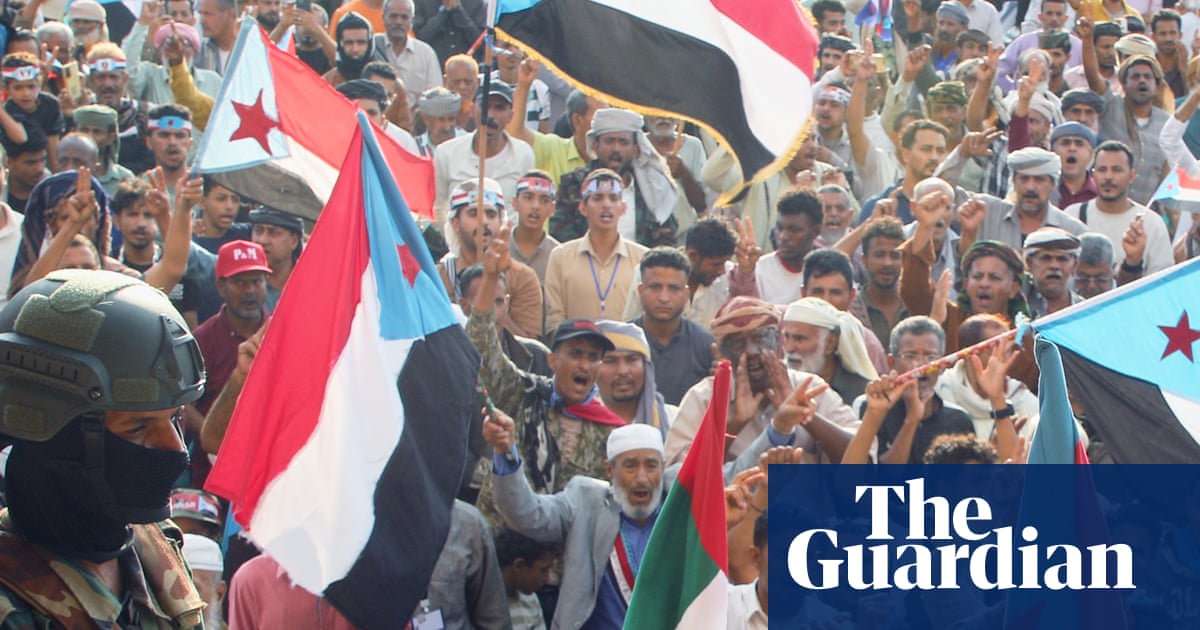

Gold is benefiting from its traditional role as a safe-haven asset – and there’s plenty for investors to worry about right now, from the Ukraine war and conflict in the Middle East to fears that inflation could get out of hand again.

Ipek Ozkardeskaya, senior analyst at Swissquote Bank, says “tense geopolitical risks in Ukraine and Gaza” are helping gold extend its rally, explaining:

For Gaza, an increasing number of developed nations are recognizing the state of Palestine, straining relations with Israel and the US – the latest being France.

In Europe, meanwhile, countries close to Russia’s border worry that Moscow is testing NATO’s nerves with repeated airspace violation.

Fears that Donald Trump could undermine America’s fiscal health by driving up borrowing, and his undermining of the US Federal Reserve, are also making gold look an attractive safe place for traders.

Central banks have been piling into gold this year too, as they look to reduce their dependency on the US dollar.

Gold’s major flaw as an investment asset is that it doesn’t pay a yield (unlike cash deposits which earn income, or bonds which pay a coupon to investors). But if central banks keep cutting interest rates, that’s less of a disadvantage for gold.

Also coming up today

Donald Trump is to meet with Argentina’s president later today, over a possible financial lifeline for Javier Milei’s government, which has been battling a run on the peso.

Investors will also be keen to hear from Federal Reserve chair Jerome Powell this afternoon, for hints as to how quickly the Fed might keep lowering borrowing costs following last week’s rate cut.

The agenda

-

8.30am BST: Sweden interest rate decision

-

9am BST: Eurozone flash PMI for September

-

9.30am BST: UK flash PMI for September

-

10am BST: Bank of England chief economist Huw Pill at fireside chat at the Inaugural Pictet Research Institute Symposium

-

11am BST: CBI industrial trends

-

5.35pm BST: Federal Reserve chair Jerome Powell speaks in New York

Key events Show key events only Please turn on JavaScript to use this feature

JLR shutdown extended by another week after cyber-attack

Newsflash: Jaguar Land Rover has extended its shutdown on car production for another week, as it continues to struggle with the aftermath of a recent cyber-attack.

JLR has just annouced that it has told colleagues, suppliers and partners that it has extended the current pause in production until Wednesday 1 October.

We have made this decision to give clarity for the coming week as we build the timeline for the phased restart of our operations and continue our investigation.

Our teams continue to work around the clock alongside cybersecurity specialists, the NCSC and law enforcement to ensure we restart in a safe and secure manner.

Our focus remains on supporting our customers, suppliers, colleagues, and our retailers who remain open. We fully recognise this is a difficult time for all connected with JLR and we thank everyone for their continued support and patience.

The shutdown has reportedly led to JLR missing out on production of 1,000 cars a day, losing £72m each day in sales.

Since the cyber-attack, which was reported at the start of this month, thousands of JLR production workers have been told not to come in to work, and reports suggest a number of the company’s suppliers have also had to tell their staff to stay at home.

A week ago, JLR had extended the shutdown until tomorrow, but today’s statement extends the disruption by another seven days. There have been reports, though, that car production may not resume until November.

The gold price is benefitting from the markets’ understanding that there are “no risk-free paths” anymore, says Stephen Innes, managing partner at SPI Asset Management.

Innes writes that the Federal Reserve (America’s central bank) does its best to balancing employment and prices while “juggling the torches of leverage, credit, and liquidity”, but history shows that it eventually hits problems:

The Greenspan era gave us the dotcom bubble, Bernanke the housing inferno, and Powell a decade of money-press confetti. Each time, the Fed “fixes” things not by truly securing the system, but by fiddling with the bolts—tightening a notch here, loosening a notch there—but eventually the whole machine rattles itself apart again.

In that stop-start circus, gold has been the one constant—the timepiece that keeps ticking when the clocks of equities and bonds stop. Since 2000, the S&P has returned 730%, while the Nasdaq has returned 800%. Gold has returned 1,280%.

Innes dubs gold a “lifeboat bolted to the deck”, adding:

Does this mean gold is riskless? Hardly. Like every asset, it climbs walls of worry and stumbles down staircases of fear. But unlike equities, its value doesn’t depend on tomorrow’s earnings whisper or the next policy pivot. It depends only on the persistence of human doubt. And doubt, as history shows, never goes out of style.

Athough gold mining can be lucrative, it can also be dangerous.

And sadly, Caledonia Mining Corporation has told the City this morning that one of its employees has died following an accident at its Blanket Mine in Zimbabwe.

The accident was related to secondary blasting (where blocks of rock are broken down into more manageable sizes).

Caledonia says:

The Company’s immediate priority is to ensure the safety and well-being of all individuals involved and to conduct a thorough investigation into the circumstances surrounding this accident. Further details cannot be released pending the outcome of an enquiry into this accident by the relevant authorities.

Caledonia expresses its condolences to the family and colleagues of the deceased.

Here’s a chart showing how much gold has risen, or fallen, each year since the late 1960s, in dollars.

Gold on track for best year since Iranian Revolution

This morning’s gains mean gold is still on track for its best year since 1979.

Gold has risen from $2,626 per ounce at the start of January to $3,759 per ounce (a new record) today, a gain of 43%.

That’s beats 2024, when it rose by 27%.

But it needs to rise rather higher to beat 1979, when the gold price more than doubled – from $226 to $512 per ounce – during a sharp bout of global inflation and a weakening dollar.

Jim Reid, market strategist at Deutshe Bank, told clients this morning:

The other asset class to reach yet more record highs was gold, which rose +1.67% to $3,747/oz and now up more than +42% on a YTD basis. So that now leaves gold prices well on track for their strongest annual performance since 1979, when prices surged +127% against the backdrop of the oil crisis after the Iranian Revolution, which caused a fresh surge for inflation and led investors to seek out gold as a hedge against that.

In real terms gold prices didn’t actually cross the highs seen around this time until earlier this month some 45 years later.

Introduction: Gold climbs to new record high

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

Gold keeps climbing, driven by geopolitical jitters, expectations of interest rate cuts, and anxiety that financial markets could have risen too high.

The spot price of gold has hit $3,759 per ounce this morning, a new record. It has gained 9% so far this month, and a blistering 43% since the start of this year.

Gold is benefiting from its traditional role as a safe-haven asset – and there’s plenty for investors to worry about right now, from the Ukraine war and conflict in the Middle East to fears that inflation could get out of hand again.

Ipek Ozkardeskaya, senior analyst at Swissquote Bank, says “tense geopolitical risks in Ukraine and Gaza” are helping gold extend its rally, explaining:

For Gaza, an increasing number of developed nations are recognizing the state of Palestine, straining relations with Israel and the US – the latest being France.

In Europe, meanwhile, countries close to Russia’s border worry that Moscow is testing NATO’s nerves with repeated airspace violation.

Fears that Donald Trump could undermine America’s fiscal health by driving up borrowing, and his undermining of the US Federal Reserve, are also making gold look an attractive safe place for traders.

Central banks have been piling into gold this year too, as they look to reduce their dependency on the US dollar.

Gold’s major flaw as an investment asset is that it doesn’t pay a yield (unlike cash deposits which earn income, or bonds which pay a coupon to investors). But if central banks keep cutting interest rates, that’s less of a disadvantage for gold.

Also coming up today

Donald Trump is to meet with Argentina’s president later today, over a possible financial lifeline for Javier Milei’s government, which has been battling a run on the peso.

Investors will also be keen to hear from Federal Reserve chair Jerome Powell this afternoon, for hints as to how quickly the Fed might keep lowering borrowing costs following last week’s rate cut.

The agenda

-

8.30am BST: Sweden interest rate decision

-

9am BST: Eurozone flash PMI for September

-

9.30am BST: UK flash PMI for September

-

10am BST: Bank of England chief economist Huw Pill at fireside chat at the Inaugural Pictet Research Institute Symposium

-

11am BST: CBI industrial trends

-

5.35pm BST: Federal Reserve chair Jerome Powell speaks in New York

3 months ago

63

3 months ago

63