Rachel Reeves has been accused of overstating the damage to the UK’s public finances from a downgrade of economic growth by the Treasury’s independent economic forecaster, the Office for Budget Responsibility.

In the aftermath of last week’s budget, the focus has turned to who knew what and when in the long run-up to the budget.

Opposition calls for the chancellor to resign have grown since Friday when the OBR said the outlook for the economy was rosier than Reeves, who was privy to early drafts of the OBR report, had given everyone to believe.

Here is a timeline of events to show how we got here.

15 June

In June the Guardian revealed that revised forecasts by the OBR would blow a £20bn hole in Reeves tax and spending plans before the autumn budget.

Insiders said the watchdog was “uncomfortable” with estimates of productivity growth going back to 2010 that had proved to be too optimistic compared with other forecasters, and wanted to “rein it in”.

This revelation was like a football team being deducted points before the start of the season. Reeves was known to be angry and dismayed that the downgrade should take place on her watch – rather than any time previously – but she quickly used it to put Whitehall chiefs on notice that a three-year spending review would be tougher than previously expected.

6 August

The National Institute of Economic and Social Research said it had looked closely at the economic situation and it was worse than anyone had previously estimated. Rather than a rumoured £20bn shortfall from poor economic growth, the hole would amount to £40bn. The thinktank set the scene for a summer of hand-wringing about Labour’s record, the impact of Donald Trump’s tariffs and the inheritance from the previous Tory government.

7 August

Richard Hughes, the then boss of the OBR, sent a confidential note to Reeves (which Hughes later mentioned in correspondence with the treasury committee) saying the OBR would reduce its central forecast for productivity growth by 0.3 percentage points. Lower productivity would mean it was downgrading its forecasts for annual growth from an average of 1.8% to 1.5% over the next five years, Hughes said. The knock-on effect would reduce tax receipts by a significant margin – £16bn.

At this stage Treasury sources insisted Rachel Reeves would stick to Labour’s election manifesto pledge not to raise income tax, national insurance or VAT, although senior Whitehall sources said the chancellor and Keir Starmer had begun a series of meetings to thrash out the shape of the budget.

3 September

The formal canter to the budget begins. Reeves says it will take place on 26 November to tackle the cost of living crisis after a fresh increase in inflation. She also says the budget will include measures to promote economic growth, but concerns persist that higher interest rates on government debt and the prospect of a productivity downgrade will force the government to raise taxes.

17 September

The OBR sent its preliminary economic forecasts – the first draft – to the Treasury. The productivity downgrade was included along with many other assessments of the outlook for the economy, most of them worse than in its previous assessment in March this year.

One aspect of the downgrade had an upside for the public finances. The OBR said inflation would be higher than it previously expected and this would put upward pressure on wages. Higher inflation increases VAT receipts and higher wages increases income tax and national insurance payments.

Hughes’s letter made clear the forecasts “included increases in real wages and inflation which offset the impact of the productivity downgrade”.

Reeves has a budget rule that forces the government to balance day-to-day spending with revenue by 2029-30.

The OBR would say in a future draft forecast, which was sent on 3 October, that the government’s current balance target would be missed by £2.5bn.

Adding the sums, and to maintain a buffer of £10bn, Reeves would need to raise about £12.5bn through tax rises or spending cuts.

26 September

Speaking to The Times on the eve of the Labour party conference in Liverpool, Reeves hinted at tax rises. She said the “challenging” productivity downgrade had forced a rethink. She failed to mention the extra income from higher wages and inflation in the OBR forecast.

29 September

Reeves said in a series of broadcast interviews before the Labour conference in Liverpool that she no longer stood by a pledge last year not to raise taxes, saying: “The world has changed” because of a mixture of conflicts, US tariffs and higher borrowing costs. Only a VAT rise was ruled out.

We now know that a team of officials had begun discussing a 2p rise in income tax offset by a 2p cut in national insurance – a plan first suggested by the Resolution Foundation thinktank that would only leave higher rate taxpayers worse off.

20 October

The OBR sent revised forecasts that gave Reeves a little more room for manoeuvre. At this stage the Treasury had a buffer of £2.1bn – lower than the previous £10bn of headroom set out in the previous budget.

27 October

The Financial Times confirmed that the OBR had made a 0.3 percentage point reduction to its trend productivity growth forecast. Initial estimates by analysts was that this would cause a £20bn hit to the public finances. There was speculation that offsetting factors could mitigate this shortfall but the extent of these was still not publicly known.

Speculation mounted that the Niesr estimates and leaks about the dramatic nature of the OBR downgrade meant tax rises would be needed to balance the books.

Reeves used a speech in Saudi Arabia to say she was prepared to raise taxes to meet her fiscal rules and provide resilience against future shocks. She added that the OBR was “likely to downgrade productivity” as a result of the financial crisis and Brexit.

31 October

The watchdog’s final forecast arrived at the Treasury suggesting the shortfall had been eliminated altogether and that there was now a £4.2bn surplus above the chancellor’s day-to-day spending plans.

This boost was not made public at the time and appears to contradict the Reeves-Starmer ultra gloomy narrative.

Asked to clarify what this meant, the OBR said last week in a letter to the Treasury committee that this was the last time any changes were made to the forecasts other than to accommodate policy changes.

In its own words: “No changes were made to our pre-measures forecast after 31 October.”

The chancellor had a checklist of extra spending commitments, including £7bn to pay for previous U-turns on cutting disability payments and winter fuel payments to pensioners, while reversing the two-child benefit cap in the budget would cost another £3bn. But she would not be blown off course by further revisions to the underlying forecasts, on that the OBR was clear.

This suggests that for 10 days Reeves and Starmer knew about the improved budget figures before apparently abandoning the income tax plan.

4 November

In a crucial intervention the chancellor took the unusual step of delivering an early morning pre-budget “scene-setter” speech.

It sparked widespread speculation that Reeves and Starmer were rolling the pitch for manifesto-breaking increases in income tax rates. Asked if this was the case, the chancellor refused to deny it.

In the speech she said: “What I want people to understand ahead of the budget is the circumstances we face. All will have to contribute.”

6 November

The Times reported that Reeves had told the OBR she planned to increase income tax. It said Reeves was attempting to fill a hole in the public finances of as much as £30bn “after a significant downgrade in productivity forecasts by the OBR”. No mention was made of extra income that had already offset the downgrade.

13 November

With growing unrest on Labour’s backbenches about the prospect of breaking a manifesto pledge, it emerged late in the evening that Reeves and the prime minister had dropped the plan for a rise in income tax.

Financial markets interpreted the move as a sign of weakness and the UK’s borrowing costs jumped the next morning.

There were already concerns inside Whitehall that the forecasts had remained the same for some time and that the last-minute change of approach was motivated by a desire not to exacerbate the sense of political turmoil surrounding the government. “There are good economic reasons not to raise income tax,” one government official said. “But politics played a part – it always does.”

14 November

Whitehall sources said Reeves would raise £7.5bn from millions of workers by freezing tax thresholds, after the decision to scrap controversial plans to raise income tax spooked the bond market.

Officials said the change had been made because forecasts showed Reeves’s fiscal hole was closer to £20bn than £30bn, allowing her to take less radical steps to raise money.

The watchdog has since revealed that the changes in its forecasts since 31 October had solely been driven by government policy proposals.

26 November

Budget Day. In a blow to the OBR’s handling of its budget report, the details were leaked almost an hour before Reeves began speaking. In a clear breach of protocol, media outlets began reporting on the contents, casing financial markets to react.

Ministers were furious at the early release. In the speech, Reeves announced £26bn of tax rises, to fund increases in welfare spending and to double the headroom to £20bn.

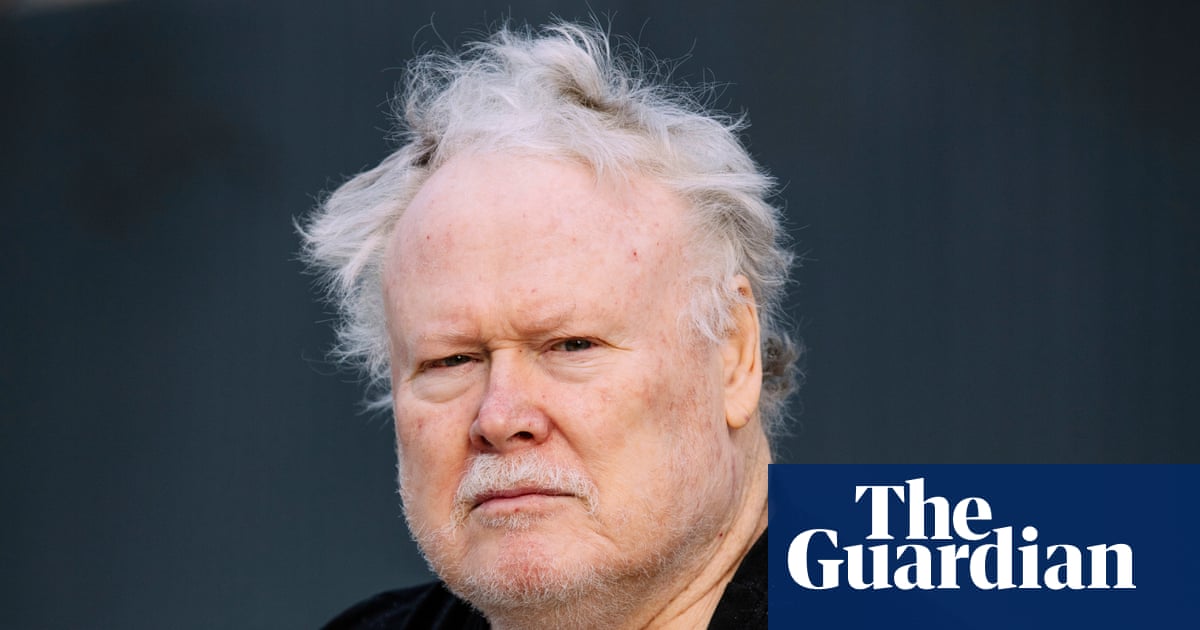

Hughes said he would continue to lead the watchdog unless he lost the confidence of the chancellor, the Treasury committee or parliament. Reeves’s spokesperson said the chancellor had “full confidence” in Hughes.

27 November

Hughes said he was “mortified” by the early release of its budget forecasts as the OBR launched a rapid inquiry into what happened, with expert input from Ciaran Martin, the former chief executive of the National Cyber Security Centre.

28 November

The government defended making hefty tax rises by citing the productivity downgrade, sparking calls from MPs, analysts and the media to know more about what Reeves knew and when.

A letter from the OBR’s Hughes to Dame Meg Hillier, the chair of the Treasury committee, set out the “evolution of our forecast between early August and budget day”.

The letter made it clear that a fiscal hole had largely been eliminated by the time the chancellor was being asked about the possibility of income tax rises.

Hughes said: “I consider it appropriate to provide the committee with some limited details from earlier forecast rounds in order to address any potential misconceptions about them.

30 November

Reeves said tax rises in the budget were to bring stability to the public finances as she denied misleading the public on the BBC’s Sunday with Laura Kuenssberg.

“I wanted to build up the fiscal, economic resilience. The headroom that I had in the spring statement of £9.9bn, I’ve taken that up to £21.7bn.”

She added: “I know that some people are suggesting that there was a small surplus that the OBR published on Friday. But if I was on this programme today and I was saying £4bn surplus is fine, there was no economic repair job to be done, I think you would rightly be saying that’s not good enough.”

1 December

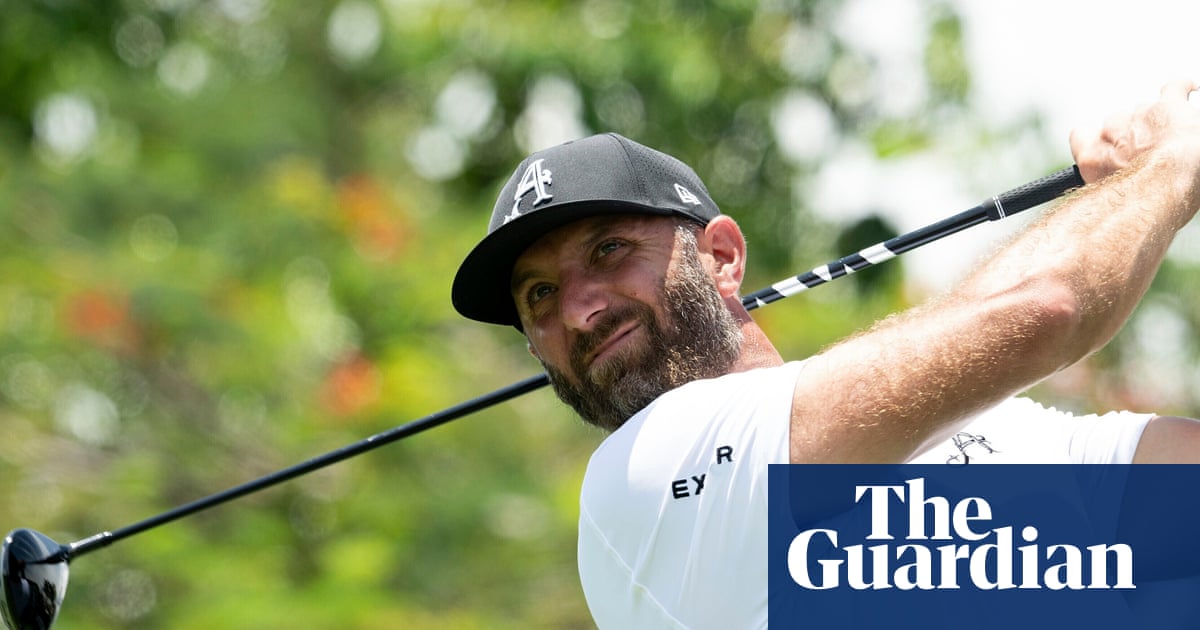

Darren Jones, the chief secretary to the prime minister and a former Treasury minister under Reeves, told BBC radio listeners that the productivity downgrade lay behind the need to raise taxes. His comments followed those over the weekend of James Murray, the chief secretary to the Treasury, as ministers rallied round Reeves.

The Tory leader, Kemi Badenoch, called on Reeves to resign, arguing it was clear that there had been an attempt to deceive the public.

Later on the same day, the findings of the urgent inquiry into the early release of the OBR’s forecasts were published. It found that the leadership of the organisation, over many years, was to blame, after identifying a weakness in its procedures. Hughes resigned.

2 months ago

63

2 months ago

63