Sir Jim Ratcliffe’s loss-making chemicals business could take longer than expected to recover its financial health because of Donald Trump’s trade tariffs, analysts have said.

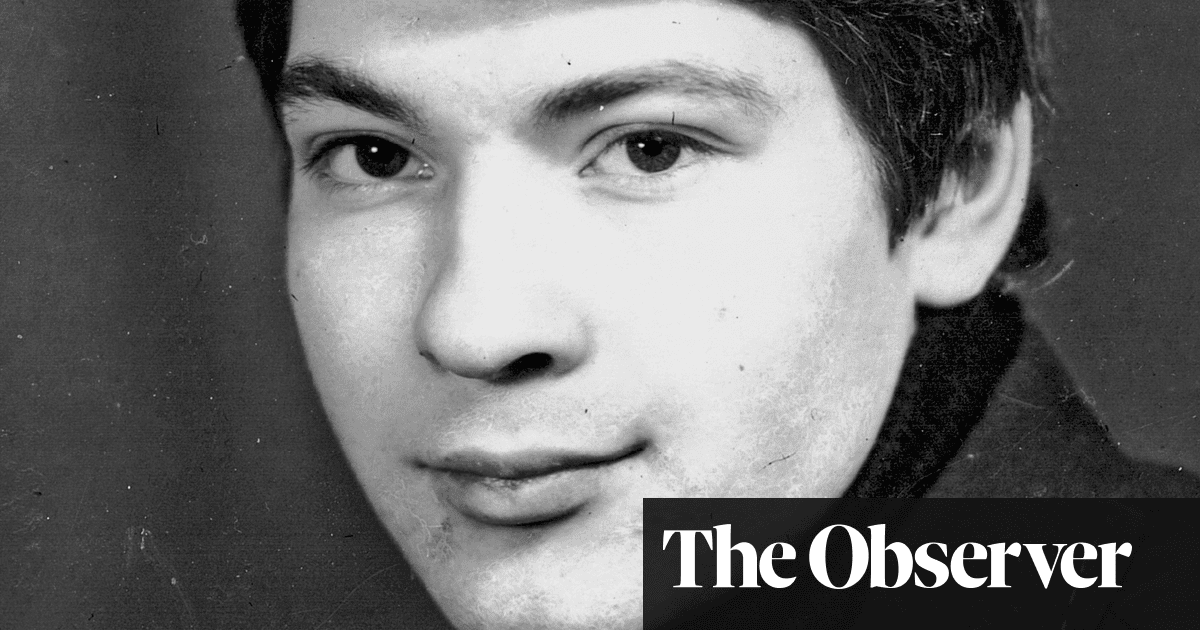

The billionaire industrialist has faced growing concerns over the state of his chemicals group amid problems with his business interests in Manchester United and All Blacks rugby.

In a fresh cause for concern, one of the key companies within Ratcliffe’s sprawling business empire, Ineos Quattro, has reported that its financial losses more than doubled to €819m (£702m) at the end of last year, from €291m in 2023, its first loss in at least five years.

The chemical company, which supplies a range of industries including carmakers and pharmaceutical companies, said in its annual report that its “substantial indebtedness” crept almost half a billion euros higher during 2024 to reach nearly €7.7bn.

The latest troubling results were released days after a leading credit rating agency, Moody’s, downgraded its outlook for the business over concerns that “trade barriers” could keep the company under pressure for the next two years.

The rating agency, which provides financial health checks for most big companies, issued the warning days after the US president set out his global trade tariffs – some of which have since been paused – which economists fear could tip major economies into recession.

Weaker economic growth typically leads to lower demand for the petrochemicals used in heavy industry, which has a knock-on effect on the demand for crude. Oil prices tumbled to four-year lows of under $60 a barrel after Trump’s tariff announcement, and the International Energy Agency has slashed its forecasts for global oil demand growth by a third for the year ahead.

Moody’s said its negative outlook for the Ineos subsidiary reflected the risk that it will not make a recovery within the next two years, “with challenging market conditions and uncertainty related to trade barriers”.

The spiralling losses at Ineos Quattro over recent years stand in contrast to the €2.3bn profit it made in 2022 from manufacturing petrochemicals at its 45 sites across the Americas, Europe and Asia.

Ratcliffe has blamed high energy costs, “the deindustrialisation of Europe” and “extreme carbon taxes” for the change in fortunes for the Ineos empire, which is made up of about 30 distinct companies that together operate more than 170 sites across 32 countries.

Ineos Group, the empire’s main corporate unit, revealed earlier this month that it would not pay out any dividends to its owners – Ratcliffe, Andy Currie and John Reece – so that the cash can be reinvested in the business, in an example of “discipline and prudent financial management”.

after newsletter promotion

Ratcliffe’s wealth fell to £23.5bn in 2024, down from £29.7bn in 2023, according to the Sunday Times.

The company also reported a swing from a pre-tax profit of €407.8m in 2023 to a loss of €71.1m last year in large part because of the rising cost of its €10.6bn debt pile. Its debts are forecast to reach almost €12bn this year, the Guardian reported in February.

A spokesperson for the company said: “Despite the challenging global backdrop in 2024, Ineos Quattro maintained its position as one of the most competitive producers in the European chemicals sector.

“We’re a low-cost, high-efficiency operator with market-leading positions and €2.14bn in cash. With strong liquidity and well-invested plants, we are well-positioned to navigate current market challenges. And we see opportunities to benefit from industry rationalisation ahead. We are confident in our ability to deliver long-term value.”

7 hours ago

6

7 hours ago

6