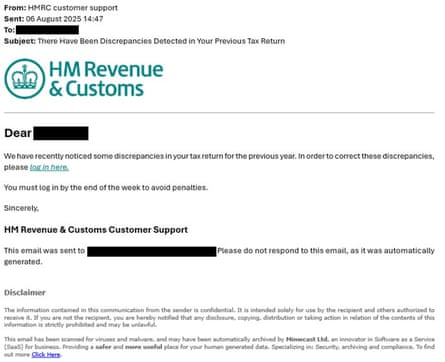

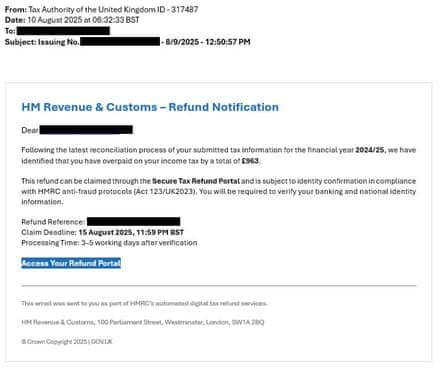

Tax calculations can be, well, taxing, so a message from HMRC saying that there’s been a mistake may not ring too many alarm bells. Some bring good news: you have overpaid and are owed a refund, but others claim you owe money. In both cases there’s an imminent deadline to act – sometimes with the threat of legal action, or penalties if you don’t.

Scammers are taking advantage of people’s fears over bills to steal personal and banking information. Automated phone calls, and messages sent by text and email, typically tell you that you need to click on a link and log in to make a payment or claim a refund.

In the year to 31 July, HMRC received more than 170,000 reports of scams, of which more than 47,000 involved fake refunds. These happen year-round, but often catch people out around the time of deadlines for self-assessment tax returns.

HMRC says it will never contact you in that way to ask you to claim a refund, or give personal details, and that it never leaves voicemail messages threatening legal action or arrest.

What the scam looks like

Messages can be very convincing and bear the logo and details of HMRC.

They will tell you to act quickly so you feel panicked into responding.

There will be a link, and the website it takes you to may also be very convincing. However, check the URL and it won’t be an official gov.uk address.

Caller ID can be spoofed so it appears that it is genuinely HMRC getting in touch.

What to do

If you think you may genuinely be owed a refund, or are concerned that you have underpaid, you can find out via your tax account.

HMRC lists the areas that it may want to contact people about, and the ways in which it may do so. You can check this list to find out what details appear on genuine messages.

Report scam messages to HMRC. You can forward emails to [email protected] and texts to 60599.

Do not trust caller ID. Put the phone down and call back later, or check your account online.

2 months ago

37

2 months ago

37