Foreign investment into the US could be threatened by Donald Trump’s new “revenge” taxes, analysts have warned.

A provision within the president’s One Big Beautiful Bill Act will allow the US to apply higher taxes on foreign individuals, businesses and investors connected to jurisdictions that impose “unfair foreign taxes” on US individuals and companies.

Companies listed on the London Stock Exchange could choose to avoid the measure by redomiciling in New York.

Section 899, as it is called, classes digital service taxes and “diverted profits taxes” as unfair, along with any taxes that target US entities. It would allow US authorities to impose an additional tax starting at 5% and increasing by five percentage points annually, up to 20%.

Max Yoeli, a senior research fellow in the US and the Americas programme at Chatham House, says section 899 “threatens to further alienate foreign investors”.

It could chill investment into the US by calling into question its “fundamental openness”, he added.

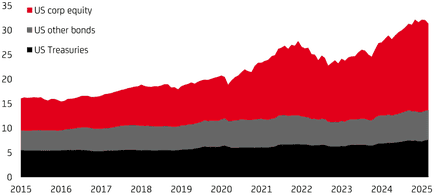

The Italian bank UniCredit agrees that section 899 could further damage foreign investor sentiment towards US dollar-denominated assets. It could backfire on the US, it says, given the large amount of domestic assets held by foreigners.

“The list of countries that would fall into this category is long and encompasses most European countries, including Italy and Germany,” UniCredit told clients, saying that foreign investors had more than doubled their holdings of US assets over the past decade.

“Not only would this additional tax serve to finance corporate tax reductions, but it would also likely be used as a negotiating tool for the US in trade deals, especially as Republicans seem willing to withdraw from the global minimum tax framework.”

UniCredit also fears the dollar’s safe haven status could be undermined if there are fresh tax disputes between the US and other countries.

The One Big Beautiful Bill Act was passed by the US House of Representatives last month. The Senate is yet to approve the bill, with the White House setting a deadline of 4 July.

George Saravelos, the global head of FX research at Deutsche Bank, warned last month that section 899 could allow the US administration to transform its trade war into a capital war by “explicitly using taxation on foreign holdings of US assets as leverage to further US economic goals”.

UK companies could certainly fall foul of section 899, as Britain operates a digital services tax aimed at tech multinationals, and a diverted profits tax designed to clamp down on tax avoidance by multinationals.

after newsletter promotion

Goldman Sachs has calculated that UK corporates are “particularly exposed” to section 899, as roughly 30% of the revenues of companies listed on the FTSE 100 are generated in the US.

However, as companies that are majority-owned by US shareholders are exempt, City bosses may consider moving their stock market listing to New York, to dodge section 899.

“This ownership dynamic not only mitigates tax risk but also reinforces the strategic case for relisting in the US, where investor bases are deeper and more aligned with US revenue exposure,” the Goldman Sachs analysts said.

According to Goldman, the large UK companies with the most significant exposure to the US, and who are not majority-owned by US investors, are the media group Pearson, the business services group Experian, the pest control business Rentokil and the pharmaceuticals manufacturer Hikma.

Ashtead Group, Compass and Melrose also generate a large proportion of their sales stateside, but as they have majority US ownership they should be exempt from section 899.

French companies could also be at risk, as Paris operates a digital services tax on the revenues that large tech companies generate in France.

3 months ago

90

3 months ago

90