On landing a new job, nothing puts a spring in the step like knowing that news of your appointment has inflated the stock market value of your employer by more than £2bn.

Dave Lewis could be forgiven for keeping that confidence-boosting figure front of mind as he faces up to the challenge of reviving Diageo.

The London-based alcoholic drinks business runs a sprawling global empire upon which the sun never sets but whose glory has been on the wane.

News that Diageo had not only ended an uncomfortably long four-month recruitment drive – but had sent for the man widely credited with saving Tesco – boosted the misfiring booze group’s shares by as much as 7% on Monday.

When Lewis formally starts work in earnest, on 1 January, many customers will be recovering from an overindulgence in Diageo brands such as Johnnie Walker and Guinness.

For the highly regarded boardroom executive, the list of new year resolutions is daunting.

Earlier this month, the investment website Motley Fool asked if it was “game over” for investing in Diageo, one of the FTSE 100’s traditional “defensive” stocks, the City term for safe bets that are resilient to economic downturns, such as pharmaceuticals and utilities.

A dispiriting trading update had sent the shares to a 10-year low, another unwanted milestone in the grim slog of Diageo’s post-pandemic journey.

A hoped-for “roaring twenties” rebound failed to materialise, not just in pubs and bars but in the wider economy, as discretionary spending fell victim to the cost of living crisis.

There have been strategic missteps too, resulting in the ousting over the summer of Lewis’s predecessor, Debra Crew, who was appointed after the untimely death of the Diageo legend Ivan Menezes.

Her tenure had been marked by a shock profits warning caused by a supply problem in Latin America that caught Diageo’s management napping.

In the run-up to Christmas last year, Diageo appeared to have misjudged its supply chain again, with UK pubs complaining that their flow of Guinness had been rationed.

Rumours swirled that Crew, a former captain in US military intelligence, might pull out the big guns. Potential strategic bazookas included an £8bn sale of the Guinness brand or Diageo’s 34% stake in the champagne and cognac business Moët Hennessy.

Diageo insiders are understood to have admired Crew’s grasp on what needed fixing but felt she lacked the bold strategic vision to steer the company out of the doldrums, let alone the ability to convince the City that she could.

Underlying the strategic concerns were long-term trends, such as declining drinking rates, particularly among younger people.

Last August, Fundsmith, the investment management company run by the City veteran Terry Smith, sold its holding in Diageo, a stake it had held since 2010.

Smith highlighted the rise of weight-loss drugs such as Wegovy. These, he said, had shown signs of effectiveness in helping people cut down on their drinking, threatening global booze sales in perpetuity.

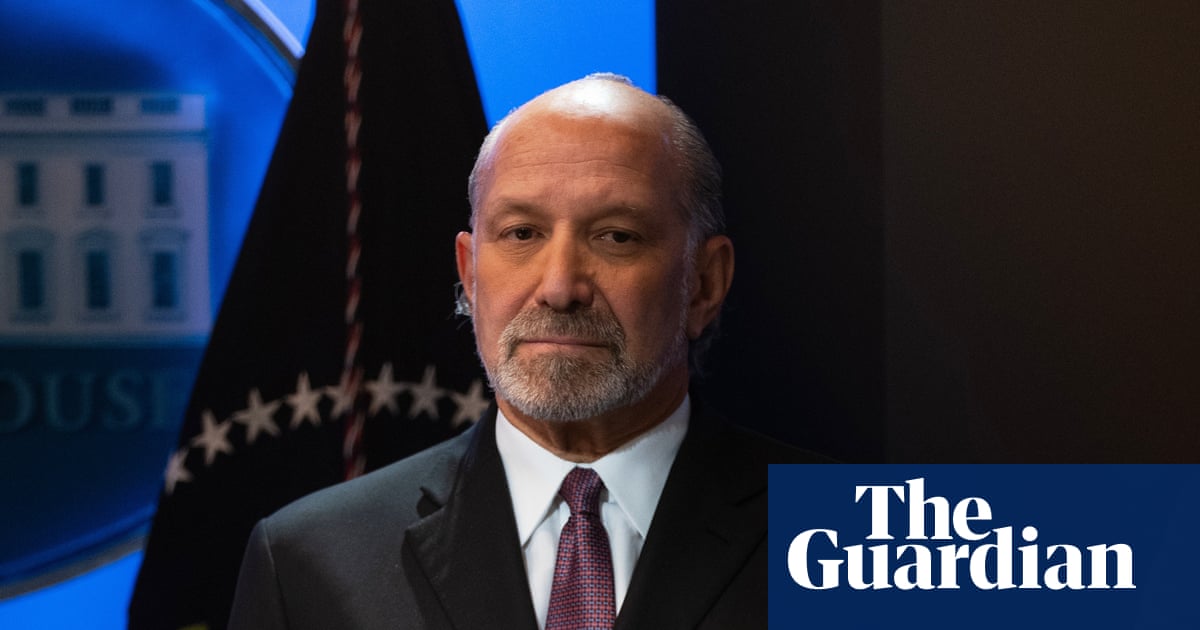

Drastic times called for “Drastic Dave”.

Lewis earned that moniker during nearly three decades at the consumer juggernaut Unilever and cemented it at Tesco.

after newsletter promotion

Diageo might be suffering a malaise but at the supermarket he inherited a company in poor financial straits and about to lurch into crisis mode due to the bombshell revelation that the business had overestimated its profits by £250m.

As he had at Unilever, Lewis displayed a flair for cost-cutting zeal, slashing thousands of jobs by closing unprofitable divisions such as electricals, slimming down its international arm and lopping off its Dobbies Garden Centres business through a sale.

“Dave Lewis is ‘Mr Fixit’ as far as the market is concerned,” said Dan Coatsworth, the head of markets at the stockbroker AJ Bell.

Javier Gonzalez Lastra, the head of European beverages research at Berenberg, hailed a “tremendous step”, predicting that Lewis would overhaul Diageo’s culture at speed.

But what drastic measures could drastic Dave pull out of his Tesco shopping bag?

AJ Bell thinks Lewis could revive the Guinness sale talk, something Diageo strenuously denied having given serious consideration to earlier this summer.

A less drastic option could involve a fire sale of some of Diageo’s stable of about 200 brands, increasing profit margins and ensuring the company’s mammoth marketing budget, of about £2.7bn a year, is more tightly focused on the best-performing labels.

Despite its woes, Diageo has so far managed to avoid cutting its dividend. Chris Beckett, a consumer staples analyst at Quilter Cheviot, thinks Lewis would have licence to rip off the plaster, incurring more short-term pain for the share price, for long-term gain.

Beckett pointed out that curbing the shareholder payout was one of Lewis’s first acts when he took over at Tesco in 2014, “whether you call it ‘kitchen sinking’ or simply accepting the reality of an overleveraged balance sheet”.

But macroeconomic challenges will remain.

Consumer confidence remains brittle worldwide, while Donald Trump’s tariffs continue to cast a pall over consumer goods. Over the longer term, questions remain over whether the impact of weight-loss drugs – and the sobriety of generation Z – are cyclical trends or the new normal.

Some things even Drastic Dave cannot fix.

3 months ago

92

3 months ago

92