Introduction: China’s economy expands at slowest pace in a year

Good morning, and welcome to our rolling coverage of business, the financial markets, and the world economy.

Growth across China’s economy has slowed to its lowest level in a year, as the trade war with the US has dampened activity.

China’s GDP expanded by 4.8% year-on-year in the July-September quarter, new data from the National Bureau of Statistics (NBS) shows shows, broadly matching expectations. That’s a slowdown from the second quarter of the year, when GDP rose by 5.2%, and also weaker than the 5.4% growth recorded in January-March.

The annual slowdown casts something of a shadow over China’s latest four-day “fourth plenum” meeting which starts today, where Communist party leaders are gathering to hammer out the country’s next five-year plan.

But on a quarterly basis, GDP grew 1.1% in the third quarter, compared with a forecast 0.8% increase and a revised 1.0% gain in the previous quarter.

Today’s data showed that China’s retail sales remained weak while factory output strengthened, a blow to hopes that its economy can rebalance away from exports and towards domestic consumption.

Growth in industrial production rose to 6.5% year-on-year in September, up from 5.2%, while retail sales growth slowed to 3% from 3.4%

The NSB took a loyally upbeat view of the economic situation, reporting that…

The national economy sustained the steady development momentum with progress against the pressure, production and supply grew steadily, employment and prices were generally stable, new growth drivers showed stable development, and the people’s well-being was ensured in a strong and effective manner.

The national economy demonstrated strong resilience and vitality.

The agenda

-

10am BST: Eurozone GDP report for Q2 2025 (updated reading)

-

3pm BST: CB Leading index survey of the US economy

Key events Show key events only Please turn on JavaScript to use this feature

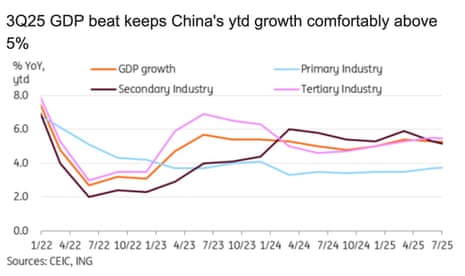

Despite slowing in the last quarter, China’s economy still seems to be on track to hit Beijing’s target of 5% growth in 2025.

That means there could be less urgency to agree new stimulus policies – something Lynn Song, ING’s chief economist for Greater China, thinks woud be a mistake.

Song explains:

With China on track to hit this year’s growth target, we could see less policy urgency. But weak confidence translating to soft consumption, investment, and a worsening property price downturn still need to be addressed.

The third quarter GDP data keeps China solidly on pace to reach this year’s “around 5%” growth target, and it may reduce the urgency for more immediate action. This could prove to be a mistake, as the underlying trend makes a strong case for more policy support.

China's new home prices fall at fastest pace in 11 months

China’s new home prices fell at the fastest pace in 11 months in September, worsening the property sector’s drag on the economy.

New home prices fell 0.4% month-on-month, following a 0.3% fall in August, according to calculations by Reuters based on National Bureau of Statistics data. Year-on-year, prices fell 2.2% in September versus a 2.5% drop in August.

That is a blow to China’s property sector, which is being dragged back by a large glut of unsold property following the end of the housing boom.

September and October are traditionally the peak season for property buying as developers launch sales campaigns to attract consumers during national holidays.

Introduction: China’s economy expands at slowest pace in a year

Good morning, and welcome to our rolling coverage of business, the financial markets, and the world economy.

Growth across China’s economy has slowed to its lowest level in a year, as the trade war with the US has dampened activity.

China’s GDP expanded by 4.8% year-on-year in the July-September quarter, new data from the National Bureau of Statistics (NBS) shows shows, broadly matching expectations. That’s a slowdown from the second quarter of the year, when GDP rose by 5.2%, and also weaker than the 5.4% growth recorded in January-March.

The annual slowdown casts something of a shadow over China’s latest four-day “fourth plenum” meeting which starts today, where Communist party leaders are gathering to hammer out the country’s next five-year plan.

But on a quarterly basis, GDP grew 1.1% in the third quarter, compared with a forecast 0.8% increase and a revised 1.0% gain in the previous quarter.

Today’s data showed that China’s retail sales remained weak while factory output strengthened, a blow to hopes that its economy can rebalance away from exports and towards domestic consumption.

Growth in industrial production rose to 6.5% year-on-year in September, up from 5.2%, while retail sales growth slowed to 3% from 3.4%

The NSB took a loyally upbeat view of the economic situation, reporting that…

The national economy sustained the steady development momentum with progress against the pressure, production and supply grew steadily, employment and prices were generally stable, new growth drivers showed stable development, and the people’s well-being was ensured in a strong and effective manner.

The national economy demonstrated strong resilience and vitality.

The agenda

-

10am BST: Eurozone GDP report for Q2 2025 (updated reading)

-

3pm BST: CB Leading index survey of the US economy

2 months ago

45

2 months ago

45