Introduction: China's Xi urges global CEOs to protect trade as Trump tariffs loom

Good morning and welcome to our rolling coverage of business, the financial markets and the world economy.

Anxiety over Donald Trump’s plan to announce a barrage of tariffs on trading partners next week is gripping the global economy, and the markets.

China’s president Xi Jinping has gathered a group of top chief executives in Beijing today, where he urged them to protect industrial and supply chains, as the trade war with the US deepens.

The gathering includes AstraZeneca’s boss Pascal Soriot, Bill Winters of Standard Chartered, Bridgewater’s Ray Dalio and Stephen Schwarzman of Blackstone, plus the CEOs of FedEx, Saudi Aramco, Toyota, Mercedes-Benz, HSBC and Hitachi.

Xi urged the assembled bigwigs,

“We need to work together to maintain the stability of global industrial and supply chains, which is an important guarantee for the healthy development of the world economy”

Around 40 executives joined the meeting, held at the Great Hall of the People in Beijing, Reuters reports.

Xi told them that overseas firms play an important role in China’s economy:

“Foreign enterprises contribute one-third of China’s imports and exports, one-quarter of industrial added value and one-seventh of tax revenue, creating more than 30 million jobs.

And he took a swipe at the trade barriers imposed by other countries in recent years, saying:

“In recent years, foreign investment in China has also been interfered with by geopolitical factors... I often say that blowing out other people’s lights does not make you brighter.”

The meeting comes less than a week before Trump’s “Liberation Day”, when he is expected to announced a wide-ranging slate of reciprocal tariffs. That could disrupt global trade flows, and push up the cost of imports to the US.

Asia-Pacific stock markets have dropped today, with China’s CSI 300 down 0.44% and South Korea’s Kospi losing 2%.

Auto companies contined to be hit by the 25% tariffs announced by Trump on Wednesday, with Hyundai Motors falling another 3.5% today.

Ipek Ozkardeskaya, senior analyst at Swissquote Bank, says sentiment remains sour due to intensifying tariff talk.

The carmakers around the world got hammered this week as the ones that produce their cars outside the US will cost 25% more if the levies go live – and nearly half of vehicles sold in the US are reportedly assembled elsewhere – and, the ones that are made in the US have at least 20% of their components coming from outside the US.

Evercore ISI predicts that US car prices will likely increase by $3000-4000 on average.

The agenda

-

7am GMT: UK GDP quarterly national accounts, October to December 2024

-

7am GMT: GB retail sales report for February

-

12.30pm GMT: US PCE inflation report for February

-

2pm GMT: University of Michigan’s US consumer confidence report

Key events Show key events only Please turn on JavaScript to use this feature

Shares in WH Smith have dropped by 2.4% in early stock market trading in London, as traders digest the sale of its high street stores for £76m.

UK trade deficit widens

Less encouragingly, the UK’s trade deficit has widened.

The total trade deficit, excluding precious metals, expanded to £10.2bn in the last quarter of 2024, up from £6bn in Q3.

The goods deficit widened by £4.8n to £59.5bn, while the services surplus nudged up by £600m to £49.3bn.

The ONS reports that total goods exports fell by £3.5bn in Q4 2024, to £86.4bn.

The largest decreases in exports of goods were recorded in:

-

finished manufactured goods (£1.8bn)

-

semi-manufactured goods (£1.2bn)

-

oil (£0.6bn)

-

other fuels (£0.3bn)

ONS chief economist Grant Fitzner says:

“The UK’s current account deficit with the rest of the world widened slightly in the latest quarter, driven by falling exports of goods.

Our balance of payments statistics for recent years have been updated to incorporate improved measurement of foreign direct investment and corrected trade data.”

UK growth stronger than expected in 2024

We also have confirmation this morning that Britain avoided recession last year.

The Office for National Statistics has confirmed that UK GDP rose by 0.1% in October-December, matching the earlier estimate, following no growth in July-September.

But the ONS has also revised up its earlier data – it now estimates the economy grew by 1.1% in 2024, up from an initial estimate of 0.9% growth. That’s because it has raised its forecast for GDP in Q4 2023, and the first two quarters of 2024, a little.

GDP is estimated is estimated to have increased by 0.1% in Quarter 4 (Oct to Dec) 2024, unrevised from the first estimate. It has been revised upwards 0.1 pp in each of Q4 2023 to Q2 2024 inclusive.

Read more ➡️ https://t.co/zPMvvOOwA3 pic.twitter.com/uAxQgLAolU

ONS chief economist Grant Fitzner explains:

“Today’s updated GDP estimates indicate that the economy grew slightly more strongly in the first half of last year than previously estimated but continues to show little growth since last summer.

“The household saving ratio increased again this quarter, with the contribution of non-pension saving at the highest rate on record outside the period affected by the pandemic.

However, the picture is less cheerful once you adjust for population changes.

Real GDP per head is estimated to have fallen by an unrevised 0.1% in Quarter 4 2024 and showed no growth across all of 2024 (revised up from the first estimate fall of 0.1%), the ONS says.

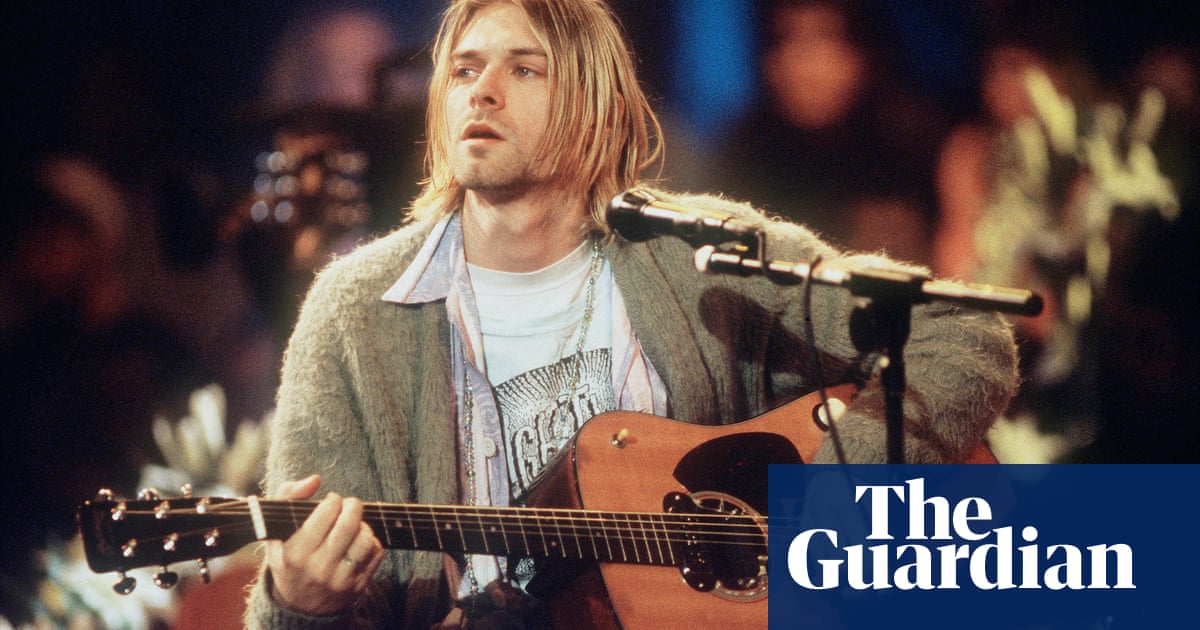

Photos: Xi meets business chiefs

Photos from China’s President Xi Jinping’s meeting with global business leaders today show that the CEOs of major financial groups, carmakers and other manufacturers were in attendance:

WH Smith sells UK high street business for £76m

Newsflash: WH Smith has agreed to sell its UK high street chain to Modella Capital, in a deal that will see the stores rebranded as TGJones.

The deal will allow WH Smith to streamline its operations and create a retailer focused on global travel, via its outlets at railway stations and airports.

The deal values WH Smith’s 480 high-street stores at £76m, with their 5,000 staff transferring to Modella under the deal.

Carl Cowling, chief executive of WH Smith, says the deal is “a pivotal moment” for the company, adding:

“We have a highly successful Travel business, operating in fast growing markets in 32 countries and we are constantly innovating to deliver strong returns and meet our customers’ and partners’ needs. Our Travel business currently accounts for around 75% of the Group’s revenue and 85% of its trading profit. With the ongoing strength in our UK Travel division, and the scale of the growth opportunities in both North America and the Rest of the World, we are in our strongest ever position to deliver enhanced growth as we move forward as a pure play travel retailer.

“As our Travel business has grown, our UK High Street business has become a much smaller part of the WHSmith Group. High Street is a good business; it is profitable and cash generative with an experienced and high-performing management team.

However, given our rapid international growth, now is the right time for a new owner to take the High Street business forward and for the WHSmith leadership team to focus exclusively on our Travel business. I wish the High Street team every success.

Introduction: China's Xi urges global CEOs to protect trade as Trump tariffs loom

Good morning and welcome to our rolling coverage of business, the financial markets and the world economy.

Anxiety over Donald Trump’s plan to announce a barrage of tariffs on trading partners next week is gripping the global economy, and the markets.

China’s president Xi Jinping has gathered a group of top chief executives in Beijing today, where he urged them to protect industrial and supply chains, as the trade war with the US deepens.

The gathering includes AstraZeneca’s boss Pascal Soriot, Bill Winters of Standard Chartered, Bridgewater’s Ray Dalio and Stephen Schwarzman of Blackstone, plus the CEOs of FedEx, Saudi Aramco, Toyota, Mercedes-Benz, HSBC and Hitachi.

Xi urged the assembled bigwigs,

“We need to work together to maintain the stability of global industrial and supply chains, which is an important guarantee for the healthy development of the world economy”

Around 40 executives joined the meeting, held at the Great Hall of the People in Beijing, Reuters reports.

Xi told them that overseas firms play an important role in China’s economy:

“Foreign enterprises contribute one-third of China’s imports and exports, one-quarter of industrial added value and one-seventh of tax revenue, creating more than 30 million jobs.

And he took a swipe at the trade barriers imposed by other countries in recent years, saying:

“In recent years, foreign investment in China has also been interfered with by geopolitical factors... I often say that blowing out other people’s lights does not make you brighter.”

The meeting comes less than a week before Trump’s “Liberation Day”, when he is expected to announced a wide-ranging slate of reciprocal tariffs. That could disrupt global trade flows, and push up the cost of imports to the US.

Asia-Pacific stock markets have dropped today, with China’s CSI 300 down 0.44% and South Korea’s Kospi losing 2%.

Auto companies contined to be hit by the 25% tariffs announced by Trump on Wednesday, with Hyundai Motors falling another 3.5% today.

Ipek Ozkardeskaya, senior analyst at Swissquote Bank, says sentiment remains sour due to intensifying tariff talk.

The carmakers around the world got hammered this week as the ones that produce their cars outside the US will cost 25% more if the levies go live – and nearly half of vehicles sold in the US are reportedly assembled elsewhere – and, the ones that are made in the US have at least 20% of their components coming from outside the US.

Evercore ISI predicts that US car prices will likely increase by $3000-4000 on average.

The agenda

-

7am GMT: UK GDP quarterly national accounts, October to December 2024

-

7am GMT: GB retail sales report for February

-

12.30pm GMT: US PCE inflation report for February

-

2pm GMT: University of Michigan’s US consumer confidence report

3 days ago

9

3 days ago

9