It is a “once-in-a-generation opportunity to upgrade the UK electricity network”, gushed Martin Pibworth, the chief executive of SSE, and you can understand his excitement. The great grid upgrade has put a rocket under his share price. SSE’s shares soared 17% on Wednesday as the group laid out plans to spend the phenomenal sum of £33bn – more than the company’s current stock market value – over the next five years.

That’s terrific news for SSE shareholders, but the stock market’s enthusiasm will do nothing to quiet two big worries about the sprint to upgrade the electricity grid. Has the regulator Ofgem – under orders from the government to get the upgrade done by 2030 – had to throw gold in the path of SSE, Scottish Power and National Grid Group, the trio behind the overall £80bn network investment programme? And what does it all mean for electricity consumers – households and businesses – who will fund this upgrade through their bills?

From the point of view of SSE’s shareholders, the worry was that the mighty step up in spending, including £27bn alone on electricity networks, would have to be backed by a hefty issue of new shares. In the event, the company reckons it needs only £2bn of new equity, coupled with the same again from disposals. Those are trivial sums in the context of the size of the plan and, crucially, the progress SSE is now predicting in its earnings and dividends.

Even while spending at an unprecedented pace, SSE thinks it can boost its dividend to shareholders at an annual rate of 5%-10% all the way to 2029-30 – not bad for a regulated utility. And the prize at the end is a much larger regulated asset base, the crucial figure used for setting network charges.

Has Ofgem been too generous? Well, at the moment its price control determinations for 2026-31 are merely at the draft stage – the final version comes next month. But it took a crew of energy suppliers at a Commons select committee last month to spell out the reality that the £80bn programme, with the charges front loaded to give the networks confidence to invest, would have an impact on bills.

“If we continue on the path we are on, in all likelihood electricity prices are going to be 20% higher – even if wholesale prices halve,” said Rachel Fletcher, the director of regulation at Octopus Energy, pointing to rising “non-commodity costs” such as gas and electricity network charges.

The government and Ofgem’s argument is that the spending is necessary to correct historic underinvestment, to pave the way for the grid to handle more renewable generation and to prepare for a projected doubling in electricity usage by 2050. That’s what Pibworth, in a similar vein, means by the “once in a generation” nature of the programme, complete with lots of jobs on the way.

Nobody doubts that chunky spending of some size is necessary. A prime target in the grid upgrade clearly has to be a reduction in the wasted billions that arise from constraint costs, the payments to windfarms (often in Scotland, SSE’s patch) to turn off because the grid locally is overloaded.

But there are still fair questions to ask about whether the full £80bn needs to be spent in just five years, and – crucially – how the front-loaded nature of the charges to bills will affect consumers and small businesses from next April.

after newsletter promotion

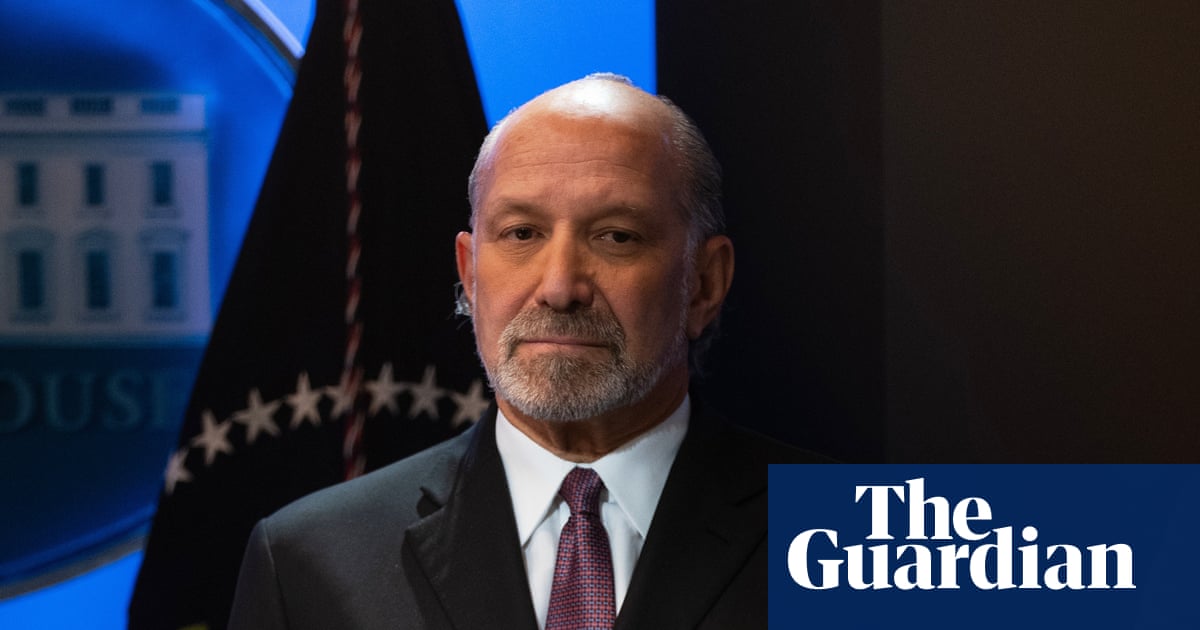

In a speech last week, Chris O’Shea, the chief executive of Centrica, the owner of British Gas, set out the arithmetic. He said: “Ofgem proposes significant upfront investment, leading to higher network charges. This raises major concerns about affordability for consumers and businesses – particularly the SMEs [small and medium-sized enterprises] – the backbone of our economy.

“These transmission costs risk significant bill increases early next year – £42 rise for domestic customers, and businesses face increases of 70% on average and some will see these [network] charges doubling next year. For businesses, this average 70% rise in network costs could translate to increases of 5%-10% in their total bills.”

He makes a fair point. Energy transition is happening but these are not trivial sums, especially for businesses, which sit outside the price cap. It’s about time Ofgem and the government acknowledged them more openly.

3 months ago

126

3 months ago

126