UK 'ended 2025 firmly in the slow lane' - what the experts say

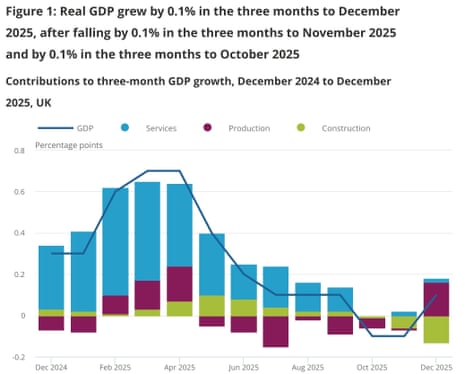

Reaction to the news that the UK grew by just 0.1% in the final quarter of 2025 (see earlier post) is rolling in, and City experts aren’t impressed.

Lindsay James, investment strategist at wealth managers Quilter, warns that the picture is ‘rather bleak at the moment’.

“A long list of data revisions from the ONS has revealed the UK economy barely kept its head above water in the final quarter of last year, with GDP growth coming in at just 0.1% after downward revisions to the previous two data prints. December saw a meagre uplift of 0.1%, which was in line with expectations, but November’s growth has been revised down to 0.2% from the 0.3% first reported.

“The Christmas period was weak by historical standards, and that is laid bare in today’s data. The services sector, which had previously been noted as the largest contributor, showed no growth and its impact was revised down from 0.2% to nothing in the three months to November too. Surprisingly, production output grew by 1.2%, having fallen by 0.1% in the three months to November, but it was outweighed by a fall of 2.1% in the construction sector which followed a 0.9% fall previously.

Scott Gardner, investment strategist at JP Morgan Personal Investing says the economy failed to hold onto the stronger growth seen in early 2025:

“The UK economy ended 2025 firmly in the slow lane, undershooting expectations and remaining in a low gear in the final quarter of the year as businesses and consumers digested the Chancellor’s November Budget. This marks a clear reversal in fortunes for the economy after strong growth shown in the first half of the year failed to carry over into the rest of 2025.

“Many will be hoping that the slow pace of economic expansion in the final quarter is only temporary after the Jaguar Land Rover shutdown stunted growth in the Autumn and led to a sharp fall in productivity. Services performed well over December, but construction and industrial production activity declined. Consumer spending showed more promising signs and has bounced back as real wage growth has fed through into higher retail and online spending.

The Unite union are calling for more investment to lift growth; their general secretary Sharon Graham says:

“Today’s figures are further proof that the UK economy will not get the growth we were promised until we reverse our historic levels of underinvestment.

“The figures also show that real household disposable income fell in 2025. Families up and down the country are getting poorer in real terms.

“We need to stop the rot and start delivering for everyday people.”

Key events Show key events only Please turn on JavaScript to use this feature

Closing post

Time to recap….

The UK economy expanded by only 0.1% in the final three months of last year, according to official data, as falling business investment and weak consumer spending led to little momentum going into 2026.

Figures from the Office for National Statistics (ONS) show that the economy grew at the same rate of 0.1% as the previous three months. This was less than a 0.2% rise that economists had been expecting.

The economy grew by 1.3% in 2025, an improvement on growth of 1.1% in 2024, although worse than official forecasts of 1.5%. The ONS said the economy also expanded by 0.1% on a monthly basis in December, slowing from 0.2% in November – a figure that was revised down from 0.3%.

The rise came despite there being no growth at all in the dominant services sector, which makes up about 80% of the economy. The small boost was instead driven by the production sector, up by 1.2%, while the construction industry shrank 2.1%, its worst performance in four years, the ONS said.

The data left the UK as the fastest growing European member of the G7 in 2025.

Chancellor Rachel Reeves predicted that growth would be stronger in 2026, pointing to the government’s efforts to lift the economy.

Economists warned, though, that the UK ended 2025 in the ‘slow lane’.

There were calls for the Bank of England to cut interest rates at its next meeting, in March.

The London stock market hit a fresh record high, over 10,500 points, before slipping back this afternoon.

Guinness strike threat ends as workers in Belfast win pay boost

Industrial action has the potential to slow economic growth, so the chancellor may be relieved that a strike at Diageo’s Guinness zero canning plant in Belfast has been cancelled.

Following a eight-day strike in December, staff at the site have now secured a significant pay increase.

The Unite union reports that workers’ pay will rise by 15.5% in a three-year deal, with the first year backdated to September 2024.

Unite general secretary Sharon Graham says:

“The Diageo workers have won an excellent pay increase through union strength in the workplace and their determination to take strike action. Their strike in December shut down the plant and secured this significant win on pay.”

The UK services sector makes up around three-quarters of the economy, so there’s concern that it stagnated in the last three months of 2025.

Thomas Watts, portfolio manager at Julius Baer, says:

“Amid intense speculation over tax rises and uncertainty following the Autumn Budget, it’s unsurprising that UK growth was revised lower in the final quarter of 2025. The data points to clear caution among businesses, with investment dropping 3% over the period.

Headline growth was flattered by the rebound in automotive production as the sector continued recovering from Jaguar Land Rover’s September cyber attack, effectively propping up output. More concerning is that the UK’s dominant services sector ended the year flat, a stark signal of softness at the core of the economy.”

Today’s GDP report shows that eight of the 14 services subsectors contributed positively to services growth.

The largest positive contributor to growth was the administrative and support services subsector, up by 1.2%, led by travel agency, tour operators and other reservation services and related activities.

The next largest positive contributions were from public administration and defence, which increased by 0.5%, information and communication, which increased by 0.4%, and human health and social work activities, up by 0.2%.

The largest negative contributor to growth in Quarter 4 2025 was professional, scientific and technical activities, which fell by 1.1%.

Meanwhile in the US, the number of people losing their jobs appears to have dropped.

There were 227,000 new ‘initial claims’ for unemployment benefit last week, which is 5,000 fewer than in the previous week.

#Unemployment - Initial jobless claims fell to 227K for the week ending February 7, down from 232K, reinforcing signs of a stable but not overheating labor market. Claims remain well below long-term averages, supporting the Fed’s patience narrative and limiting near-term downside… pic.twitter.com/wJNwJJLbof

— Brad Horn (@bxhorn) February 12, 2026Reeves: Confident of stronger growth this year

Chancellor Rachel Reeves has predicted there will be stronger growth in the UK economy this year than in 2025.

Speaking after this morning’s data showed annual growth rose to 1.3% last year, Reeves says the government is creating the “conditions for growth”. She cites the six cuts to interest rates since the 2024 election, inflation set to fall towards the 2% target, reductions on energy bills set for April, and the planning and infrastructure bill.

Reeves says:

We can’t turn things around overnight, but we have created the conditions now for the economy to grow and it is doing just that.

I’m confident that the decisions that we have made to return stability to the economy, to bring investment to our economy, and the changes we’re making around planning an regulation will help deliver stronger growth this year, building on the economic growth we’ve seen in 2025.

The chancellor also spoke about GDP per capita accelerating last year – it did indeed rise by 1.0% annually in 2025, but actually shrank in the third and fourth quarters.

Andrew Sentance, a former Bank of England policymaker, reckons the UK is on track for “the most dismal decade for growth in 100 years”.

It may be a little early to be calling this race (we’re only halfway through the decade!), but Sentance has spotted that annual growth in the 2020s is below the historic average, and the weakest since the ‘roaring 20s’.

GDP up 0.1pc in the final quarter of last year - continuing the recent pattern of very weak growth. Economy grew by just 1.3pc in 2025 as a whole, with the 2020s on course for the worst UK growth performance since the 1920s - the most dismal decade for growth in 100 years! pic.twitter.com/5TGYitvu4K

— Andrew Sentance (@asentance) February 12, 2026BAT expected to cut jobs through AI productivity drive

British American Tobacco (BAT) is set to cut jobs and increase its use of AI as part of efforts to “simplify” its operations.

BAT, which sells cigarettes, tobacco and other nicotine products, announced a new AI-driven productivity programme this morning. Interim finance chief, Javed Iqbal, said it will allow BAT to simplify and automate using data analytics and AI tools, adding it would affect staffing levels.

He told a call:

“It will have an impact on the size of the organisation.”

The UK economy may shift out of the ‘slow lane’ in the current quarter, although it’s still unlikely to hit top gear.

NIESR, the economic research institute NIESR, has predicted that UK GDP is expected to grow by 0.3% in the first quarter of 2026.

Fergus Jimenez-England, associate economist at NIESR, says:

“Today’s GDP figures show that growth in 2025 was 1.3 per cent, coming in slightly below expectations. The fourth quarter only just scraped together a positive growth figure, with services disappointingly showing no growth.

That said, surveys point toward a recovery in business sentiment in the New Year after months of damaging speculation in the run up to the Autumn Budget.

With the Spring Statement upcoming in March, the Chancellor should look to support this change in sentiment by avoiding a repeat of last year and refrain from further policy changes.”

In a relief for struggling homeowners, the number of people falling into arrears on their mortgages – or having their property repossessed – has fallen.

Industry body UK Finance has reported a 4% decrease in homeowner mortgages in arrears in the last quarter of 2025, while the number of buy-to-let (BTL) mortgages in arrears fell by nine per cent compared with the previous quarter.

UK Finance says:

In the fourth quarter of 2025, there were 80,490 homeowner mortgages in arrears of 2.5 per cent or more of the outstanding balance. This was a four per cent decrease compared with Q2 2025. The overall proportion of mortgages in arrears remains low, at 0.92 per cent of homeowner mortgages and 0.5 per cent of BTL mortgages.

Within this total, 27,780 homeowner mortgages were in the lightest arrears band (representing between 2.5 and 5 per cent of the outstanding balance), four per cent fewer than in the previous quarter.

The number of BTL mortgages in arrears also fell, down nine per cent compared with the previous quarter, to 9,520.

Mary-Lou Press, president of the National Association of Estate Agents, comments:

“We are starting to witness the positive impact of proactive lender engagement and the resilience shown by many borrowers despite ongoing cost-of-living pressures and higher interest rate environments over recent years. The fact that arrears levels are a fraction of those seen during the 2009 financial crisis offers important reassurance about the overall stability of the housing market.

“The decline in buy-to-let arrears is particularly notable. A stable and financially secure landlord base is essential to sustaining supply in the private rented sector at a time when demand remains extremely high. Continued lender flexibility and early engagement will be key to ensuring landlords can manage financial pressures while maintaining much-needed rental homes.

Analysis: UK economy limps along. but there are reasons for optimism in 2026

Our economics editor, Heather Stewart, also sees reasons to be more optimistic for 2026:

Policymakers at the Bank of England’s rate-setting meeting last week pointed the way to a seventh interest rate cut, perhaps as soon as next month, despite leaving rates unchanged at 3.75%.

That was largely because, alongside post-dated tax rises, Rachel Reeves’s budget included a slate of price-cutting measures, including a reduction in energy bills, which will help inflation to move back down to target.

The Treasury will be hoping that another rate cut, alongside its anti-inflation measures, will cheer up wary consumers and reassure businesses. Forward-looking surveys have pointed to an upturn of late, though there is continued anxiety about job cuts.

Reeves will have been encouraged by news that business investment, which Labour sees as crucial to improving the UK’s flailing productivity, was up 3.5% in 2025 (though it fell in the fourth quarter).

More here:

Although today’s GDP report was disappointing, the UK’s economic prospects are brighter, analysts at Nomura argue.

They told clients:

It was a lacklustre end to 2025 for the UK economy, with growth of just 0.1% q-o-q in Q3 and Q4. Consumer spending grew modestly in Q4 but remains depressed relative to the UK’s peer group, while business investment fell.

Prospects look brighter, however, with expectations (BoE, consensus, ourselves) for an economic recovery in 2026 and beyond. Lower interest rates should help, but any bounce in growth will likely require a fall in the saving ratio – especially if the BoE’s view of weak real income growth proves correct.

IEA cuts forecast for oil demand growth

The International Energy Agency has cut its forecast for oil demand growth this year.

In its monthly report, the IEA has revised its forecast for world oil demand growth for 2026 “moderately lower” to 850,000 barrels per day as “economic uncertainties and higher oil prices weigh on consumption”. That’s up from 770,000 barrels/day in 2025.

The IEA also predicted global oil supply will rebound in the coming months, after an “exceptional plunge in January” due to extreme winter weather in North America, and disruptions at Kazakhstan’s key export terminal since November.

7 hours ago

6

7 hours ago

6