Unemployment in the UK has risen by more than expected to the highest level in four years, official figures show, amid a worsening slowdown in the jobs market before Rachel Reeves’s autumn budget.

With under three weeks to go before the chancellor’s tax and spending statement, figures from the Office for National Statistics (ONS) show the headline unemployment rate rose to 5.0% in the three months to the end of September, up from 4.8% in the previous quarter.

City economists had forecast an increase to 4.9%. Representing an increase in unemployment to 1.8 million, the official jobless rate was last higher in January 2021, during the height of the Covid pandemic.

Suren Thiru, the economics director at the Institute of Chartered Accountants in England and Wales, said: “These figures suggest that the UK’s labour market is suffering from pre-budget jitters, as businesses already weakened by April’s rise in national insurance look to cut recruitment further in anticipation of another difficult budget.”

Concerns over the strength of the jobs market could encourage the Bank of England to cut interest rates from as early as next month.

Threadneedle Street kept rates on hold last week, but opened the door to a December cut in borrowing costs after signalling that inflation had peaked amid a slowdown in the economy.

It forecast unemployment could push further above 5% next year, in a development with potential to cool inflationary pressures by making it harder for workers to bargain for higher wages and for businesses to raise their prices.

The ONS’s figures are based on its widely criticised labour force survey, which has suffered from collapsing response rates. Experts have argued this leaves policymakers “flying blind”, risking decisions being taken based on flawed data.

However, separate data suggests the jobs market has slowed sharply, as employers come under pressure from tax increase, stubborn inflation, elevated borrowing costs and a sluggish growth outlook.

Figures from HMRC published on Tuesday showed the number of workers on company payrolls fell by 180,000 in the year to October, and by 32,000 compared with September.

Reeves is expected to raise taxes in the budget on 26 November to plug a shortfall in the public finances of up to £30bn. However, the chancellor has been warned that doing so could hit jobs and growth in a repeat of her first autumn budget.

after newsletter promotion

Business leaders have warned Reeves’s £25bn rise in employer national insurance contributions and increase in the national living wage from April has led to job cuts and sapped hiring demand, hitting part-time employment and jobs in the hospitality, leisure and retail sectors in particular.

While the ONS said the total level of job vacancies was broadly flat in the three months to October, the figure was down by 99,000 from a year earlier. Over the past year, the biggest falls in payrolled employment were in the wholesale and retail, accommodation and food services, and IT sectors.

Martin Beck, the chief economist at WPI Strategy, said: “The prospect of new tax rises in the upcoming budget poses further risks to employment, particularly if the chancellor again looks to raise taxes on businesses. But this time, Rachel Reeves is more likely to target earners rather than employers.”

Highlighting the worsening slowdown in the jobs market, annual growth in average weekly earnings dropped by more than expected to 4.8%. City economists had forecast an unchanged reading of 5%.

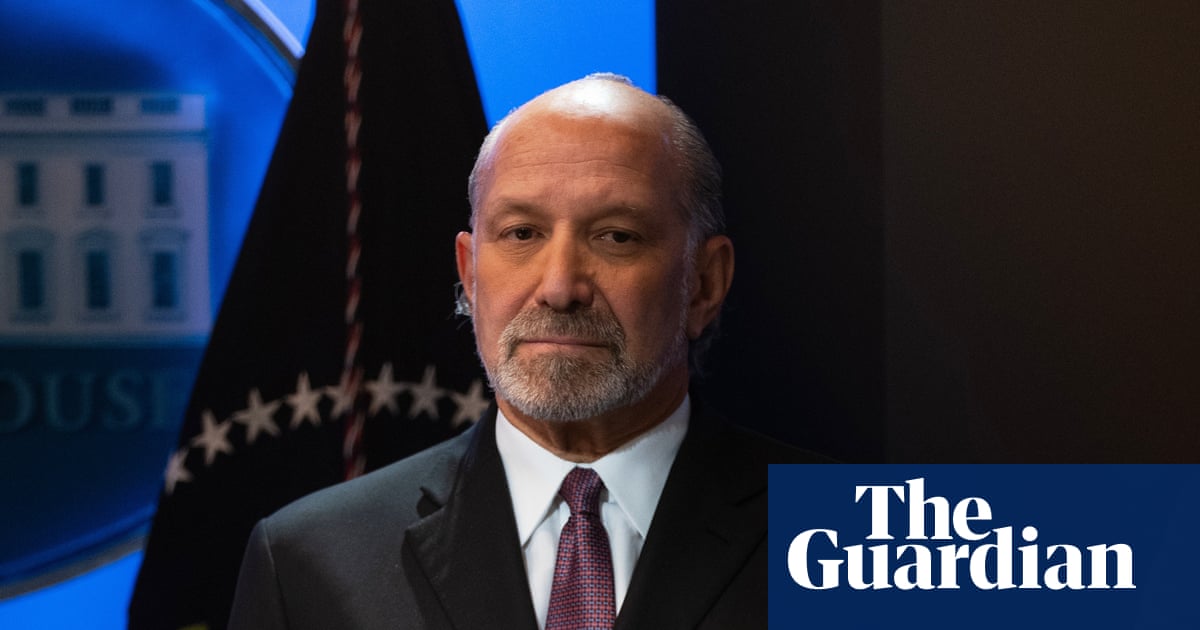

The secretary of state for work and pensions, Pat McFadden, said: “Over 329,000 more people have moved into work this year already, but today’s figures are exactly why we’re stepping up our plan to get Britain working.

“We’ve introduced the most ambitious employment reforms in a generation to modernise job centres, expand youth hubs and tackle ill-health through stronger partnerships with employers.”

3 months ago

130

3 months ago

130