Reach into your pocket and you will probably find evidence of Tesco. Whether it is a Clubcard, mobile phone or just a receipt from one of its 3,000 stores, the UK’s biggest retailer is engrained in everyday British life.

As its chief executive, Ken Murphy, proudly proclaimed this month, the supermarket chain has grabbed even more of our spending this year, landing almost a third of all grocery sales and receiving more than £1 in every £10 spent in UK retail. Data released this week showed Tesco’s sales growth outgunning its traditional rivals.

The retailer’s resurgence represents a remarkable turnaround for a business whose relentless growth across Britain through the 1990s and early 2000s was abruptly curtailed as management became too focused on overseas expansion and profits over service.

A devastating accounting scandal in 2014 appeared to close the chapter on a corporate success story that had regulators and politicians concerned about its all-encompassing dominance. Now, Tesco seemingly has its mojo back and is quietly reasserting its stranglehold on the UK market – this time in a far less visible manner.

‘Every little helps’

The term “Tescopoly” was first coined in the noughties, when concerns about the retailer – and it supermarket peers – putting local high street shops out of business were at their height.

Regulators allowed Tesco, then led by Sir Terry Leahy, to buy up the 860-store convenience chain T&S Stores in 2002, and it later marched into selling electrical goods, homewares and clothing in its out of town Homeplus stores from 2005. Tesco had already set up a banking venture with Royal Bank of Scotland in 1997 and its mobile phone service with O2 in 2003.

Huge superstores were built on the edge of towns around the country and there were concerns about it hoarding land to block rivals from setting up shop nearby and using its dominant scale to bully suppliers.

“Nowhere is it written on the sliding supermarket doors that by crossing the threshold your vibrant, distinctive local economy will begin to wither,” wrote Andrew Simms, the author of 2007’s Tescopoly: How One Shop Came Out on Top and Why it Matters.

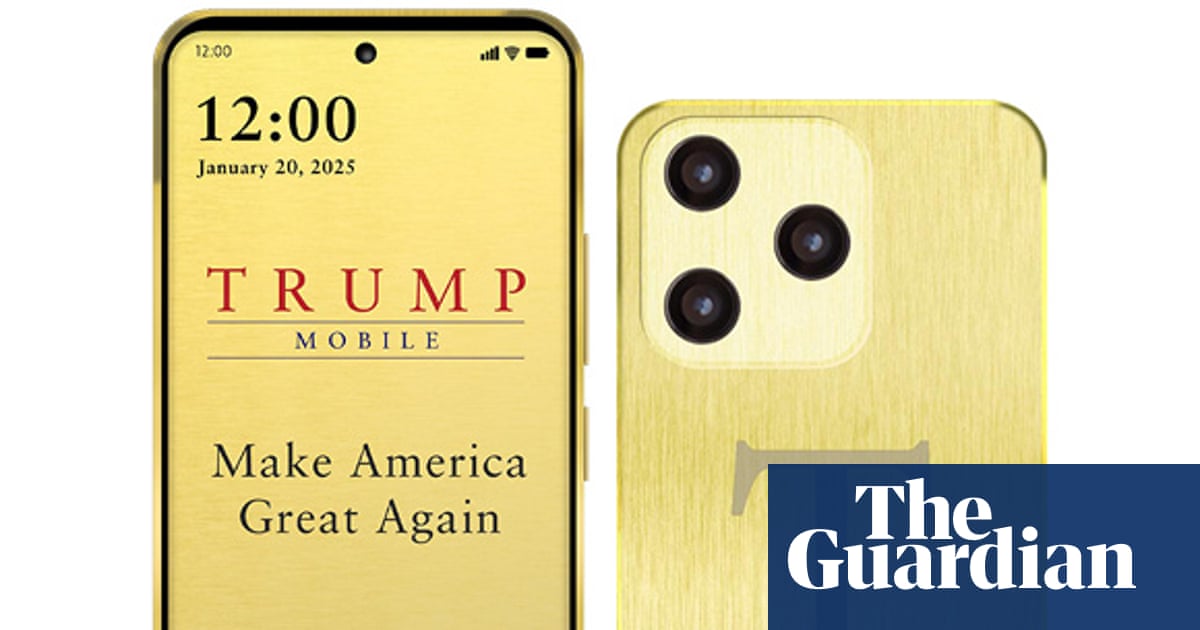

By the time Tesco tried to take on Amazon and Apple with the Hudl tablet computer in 2013, it seemed there was no area of life where the supermarket did not reach. Cafes and restaurant chains, such as Harris + Hoole and Giraffe, had been acquired to help fill the giant stores, which had become unloved.

Today, Hudl, Homeplus and even Giraffe may be just a memory of a hubristic time when Tesco had operations across the world from the US to South Korea, while regulators have since acted to prevent the holding of land to block rivals. However, with its globetrotting ventures much reduced, those close to the business say remaining the grocery kingpin in the UK and selling a wider variety of products to shoppers has become even more important.

Kings of convenience

At its peak in 2007, Tesco’s market share neared 32%, driven by huge scale and punchy marketing. Today that figure stands at 28.3%, up from as low as 26.5% in 2020. Although the figure remains some way off its high, Tesco’s new UK boss Ashwin Prasad reportedly told suppliers the retailer wants to top 30% again. Its nearest competitor, Sainsbury’s, trails well behind, on 15.3%.

Small stores and online retail are likely to be the engine room of that growth. Since its launch in 1994, Tesco Express has rapidly filled the gaps in emptying high streets to bring in local shoppers. Rather than adding to its 809 hypermarkets in the UK, the retailer is expanding via dozens of convenience stores a year, with Tesco Express adding 43 sites this year taking the total to 1,675, according to Lumina Intelligence.

The Worldpanel Tesco grocery market share figure does not include the 730 One Stop shops it operates and 354 more it supplies through a franchise deal or the thousands of independent retailers that buy goods via Tesco’s Booker wholesaler, including under its Premier, Londis and Budgens brands.

Concerns have been raised about Tesco’s power over small local shops, with Premier accounting for the largest number of convenience shops in the UK, and numbers rising to 4,800 this year, from 4,760 in 2024. Londis edged up to 2,490 from 2,465, and Budgens by six to 452.

Unlike in the noughties, when buying groceries online was extremely niche, today 14% of Tesco’s sales are ordered from home, with sales growing by 11% in the first half of the year on a year earlier.

In that market, Tesco is even more dominant than in stores, controlling 37% of the UK’s online grocery sales.

Last June, Tesco launched its new marketplace, which now sells 600,000 items, from dog beds to toys, laptops and tents.

The growth of online shopping has also offered Tesco new avenues to lure consumers: once simple money-off vouchers were its preferred discount method; now more subtle, targeted digital ads are also deployed.

The power of Clubcard

Aside from using its scale to secure better deals from suppliers and operate efficiently, Tesco is also using heavy investment in technology to offer personalised deals through its Clubcard loyalty scheme, now in the hands of 24 million UK households, to make it tougher for rivals to prise away its shoppers.

In recent years Tesco has made Clubcard an essential by offering markedly lower prices for cardholders while also gamifying the card – offering discounts if shoppers can meet a “challenge” such as racking up a certain number of purchases within a week.

Tesco also plans to extend its reach in the non-food market via its online marketplace and potentially through acquisitions of brands such as Paperchase or joint ventures, such as with the toy retailer The Entertainer. The idea is to make the most of its Clubcard database to sell those households a much wider range of goods.

“Tesco has a huge opportunity on non-food,” says Richard Hyman, a retail analyst at Aria Intelligent Solutions. One industry insider adds that Clubcard means Tesco “knows a lot about people’s lives and gives opportunities to sell things that go well beyond groceries”.

Tesco’s revival has not gone unnoticed by its critics. The vast profits made during the cost of living crisis and the £9.2m paid to Murphy last year have made it the target of union ire.

The Unite general secretary, Sharon Graham, said: “Every day people are on their knees and being kicked while they are down. This is profiteering pure and simple. Tesco made £3.1bn profit last year and its sheer size means that the game is rigged from the start. It is obscene. Where is the off button?

“Tesco’s dominance means it can squeeze suppliers while boosting its own profits. This then feeds into more food inflation and worsens the cost of living crisis for workers and communities.”

One supplier source says Murphy is “much more demanding” than under previous regimes, but in a way that is “collaborative and not brutal”.

A changing retail landscape

Tesco – one of the UK’s biggest employers – has also benefited from a historically rare moment when two of its major competitors are in the doldrums and a third has seen growth stagnate. The UK’s number three grocer, Asda, has been losing sales amid struggles with heavy debts from a private equity takeover.

Another major rival, Morrisons, is also weighed down with debts and imminently expected to be overtaken in market share by Lidl as sales remain behind inflation, while Aldi’s growth has softened somewhat.

A Tesco spokesperson said: “Our performance is driven by the fact that more customers are choosing to do more of their shopping with us, as a result of the sustained investments we’re making in value, quality and service – supported by the extension of our savings programme, which is on track to deliver circa £500m of savings this year.

“Despite continued inflationary headwinds, including from tax and regulation, we’ve worked hard to keep prices down for customers and as a result we have further improved our price position against the market.”

Threats still remain to Tesco’s growth. The chain faces the looming presence of Aldi and Lidl, which continue to open dozens of stores a year in the UK, backed by vast European operations capable of pressing Tesco on price.

Changing market dynamics could also have a role in keeping Tesco in check. Asda’s and Morrisons’ struggles have led to speculation that one of them will be broken up in the next few years, with Sainsbury’s a potential buyer of a large chunk of stores in northern regions where it is under-represented and the well-funded Co-op perhaps keen to take on more convenience stores.

While Sainsbury’s attempt to buy Asda in 2019 fell foul of the competition regulator, the potential sale of a troubled major player could lead to a reassessment of a merger particularly since the appointment of the former Asda and Amazon executive Doug Gurr to head the Competition and Markets Authority. He has a remit to promote the government’s growth agenda, which may well clear a path to new deals.

“I think we will see a redrawing of the competitive landscape in the next three or four years,” Hyman says. Another senior industry source puts it more bluntly: “I cannot see both Asda and Morrisons persisting as independent businesses on a 10-year view.”

Meanwhile, the dominance of Amazon – as well as the growth of Shein and Temu – offers tough competition on non-food.

Patrick O’Brien at GlobalData says that Tesco’s profit margins – of 4.5% – remain relatively slim on its £63.6bn of worldwide sales. “Currently, you’d be hard pressed to argue for much concern, such is the competitiveness of the UK market, especially in grocery.”

Leigh Sparks, the professor of retail studies at the University of Stirling, says Tesco’s market share has “moved up sharply” in the last two years. “I don’t think we should be as worried as we were 20 years ago,” he says. “It is a watching brief. If [its market share] continues to accelerate as in the last couple of years then it could be a concern.”

2 months ago

84

2 months ago

84