Capital Economics: Dismal backdrop for the Autumn Budget

September’s public finances, showing borrowing at a five-year high, highlight the poor performance of the public finances even though the economy hasn’t been terribly weak, says Ruth Gregory, deputy chief UK economist at Capital Economics.

They suspect Rachel Reeves will need to raise about £27bn in the Budget on 26 November, mostly through higher taxes.

Gregory explains:

The government borrowed £20.2bn on the main public sector net borrowing measure in September and £13.4bn (OBR forecast £12.2bn) on the current borrowing measure (which is what matters for the Chancellor’s fiscal mandate).

This means that after six months of the financial year, public sector net borrowing is already £7.2bn higher than the OBR forecast at the Spring Statement in March.

The overshoot in the Chancellor’s chosen fiscal mandate of the current budget is even greater, at £13.0bn. It would now take a big turnaround over the remainder of the year to put borrowing in 2025/26 back on track to meet the OBR’s forecast

Key events Show key events only Please turn on JavaScript to use this feature

In the utilities world, Thames Water’s appeal to be allowed to raise bills by more than the regulator allows has been delayed again.

The referral to the Competition and Markets Authority (CMA) has already been deferred twice, while Thames Water tries to hammer out a rescue deal with its creditors.

And today, the company and Ofwat have agreed a third delay, while discussions continue between creditors, regulators and the company.

This means a longer delay before the CMA can ponder Ofwat’s decision to allow only (!) a 35% bill increase over five years.

Thames Water Utilities Limited (TWUL) explains:

This deferral is not a withdrawal of the request for the Reference and TWUL remains of the view that the Final Determination does not serve the interests of Thames Water’s customers, communities and the environment.

TWUL remains focused on delivering a recapitalisation transaction which delivers for its customers and the environment as soon as practicable.

Earlier this month the CMA allowed five water suppliers to increase bills by more than Ofwat had allowed, but still by not as much as they wanted:

OBR: Latest tax receipts data reduces UK's borrowing overshoot

The UK’s fiscal watchdog, the Office for Budget Responsibility, has issued its verdict on today’s public finances.

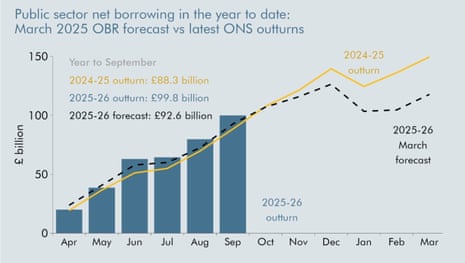

They confirm that borrowing so far this financial year (£99.8bn) is £7.2bn over their March forecast, as this chart highlights:

But in better news for the chancellor, the OBR point out that newly revised estimates of tax receipts for the year-to-date have reduced the estimated borrowing overshoot compared to last month.

The OBR explains:

Central government accrued receipts and spending are now both close to the forecast profile for the year-to-date. Borrowing remains higher than in our March profile because of higher estimated borrowing by local authorities and public corporations.

The watchdog also predicts borrowing will be lower in the second half of this financial year (October-March), due to “a sharp rise in capital gains tax expected around the end-January due date, lower debt interest payments in the second half of the year, and lower growth in central government net social benefits which were unusually backloaded last year.”

Julia Kollewe

The Crown Estate has bought a chunk of farmland next to a major science hub in Oxfordshire where it plans to build labs, offices and up to 400 homes.

This is part of the organisation’s pledge to invest up to £1.5bn in science and technology over the next 15 years. The site, called Harwell East, could deliver up to 4.5m square feet of laboratory and advanced manufacturing space, offices and new homes.

It sits next to the Harwell science campus, where US biotech Moderna has just opened a major new vaccine research and manufacturing centre. More than 200 organisations are now on the site, which forms part of the “golden triangle” of Oxford, Cambridge and London.

The Crown Estate oversees the royal family’s ancient portfolio of land and property across England and Wales that includes the seabed around its coasts and £15bn of property, including in London’s West End. A slice of its profits are used to fund the work of the monarchy.

Dan Labbad, chief executive of The Crown Estate, said:

“The UK’s science, innovation and technology community is pushing the boundaries of progress in areas from AI to advanced manufacturing. But they need the specialised lab facilities and housing to realise potential.

“The ambition of Harwell East is to create the space for great science to flourish, and to fuel growth and success not just in the region but for the benefit of the whole country.” This comes after the Crown Estate came under mounting criticism.

Last week, Greenpeace threatened to sue King Charles’s property management company, accusing it of exploiting its monopoly ownership of the seabed and driving up the cost of offshore wind.

Allianz Trade: bankruptcies could surge if AI boom bursts

There could be a surge of company insolvencies if the artificial intelligence boom bursts, a new report today warns.

Allianz Trade, the trade credit insurer, has calculated that thousands of firms could be at risk across Europe and the US, if the enthusiasm about AI were to unravel.

In their latest Global Insolvency Outlook, Allianz Trade predict:

If the current AI-induced boom were to burst in a shock similar to the dotcom bubble of 2001-2002, we expect a surge of bankruptcies by +4,500 companies in the US, +4,000 in Germany, +1,000 in France and +1,100 in the UK. Over the last few years, business creation has accelerated, particularly in Europe where new registrations were 9% higher in 2021-2024 compared to 2016-2019, and in the US, where business applications are 36% higher.

Allianz Trade is concerned that the recent proliferation of new businesses, particularly in the tech sector, significantly heightens insolvency risks, through “multiple interrelated mechanisms”.

Firstly, startups and younger firms intrinsically face higher financial vulnerability and insolvency risk compared to established businesses that possess greater resources to weather economic downturns.

Secondly, these new market entrants often intensify competition through aggressive pricing strategies or innovative offerings designed to capture market share, creating pressure across entire sectors.

Third, a higher number of firms often leads to more fragile firms when the economic and financial cycle is weakening.

Allianz Trade also forecast that global business insolvencies will rise by +6% in 2025, and again by +5% in 2026, before a modest decline by –1% in 2027.

But in the UK, business insolvencies are forecast to dip slightly this year, to 26,750, and then ease again to 25,900 in 2026.

Nikkei hits record high as Takaichi

Japan’s stock market has risen to a new record high today, on relief that pro-stimulus politician Sanae Takaichi will become the nation’s first woman prime minister.

The Nikkei 225 index rose 0.3% to close at 49,316 points, a new peak, after Takaichi won a parliamentary vote to become PM. Shares were lifted by expectations that Takaichi will push for looser fiscal policy, echoing Shinzo Abe, her former predecessor who was killed in 2022.

Ipek Ozkardeskaya, senior analyst at Swissquote, explains:

She will push for looser monetary policy and larger fiscal stimulus — if – of course - markets will let her. Because note that long-term Japanese yields are already near multi-decade highs, which suggests she and Abe (to whom she’s compared) do not share the same margin to manoeuvre.

The pound has dipped slightly on the back of the jump in UK borrowing.

Sterling is a little lower against the US dollar this morning, at $1.3395.

Kathleen Brooks, research director at XTB, says:

Overall, today’s public finance figures in the UK suggest that 1) there are deep set financial problems in the UK, and 2) the November budget is now virtually assured to be painful for all, without public sector spending consolidation.

Chief Secretary to the Treasury James Murray has responded to today’s borrowing figures, saying:

“This Government will never play fast and loose with the public finances.

“We know that when you lose control of the public purse it’s working people who pay the price.

“That’s why we plan to bring down borrowing and, according to IMF (International Monetary Fund) data, are set to deliver the largest primary deficit reduction in both the G7 and G20 over the next five years.

“We are cutting waste, improving efficiency and transforming our public services for the future so that we can be rid of costly debt interest, instead putting that money into our NHS, schools and police.

Capital Economics: Dismal backdrop for the Autumn Budget

September’s public finances, showing borrowing at a five-year high, highlight the poor performance of the public finances even though the economy hasn’t been terribly weak, says Ruth Gregory, deputy chief UK economist at Capital Economics.

They suspect Rachel Reeves will need to raise about £27bn in the Budget on 26 November, mostly through higher taxes.

Gregory explains:

The government borrowed £20.2bn on the main public sector net borrowing measure in September and £13.4bn (OBR forecast £12.2bn) on the current borrowing measure (which is what matters for the Chancellor’s fiscal mandate).

This means that after six months of the financial year, public sector net borrowing is already £7.2bn higher than the OBR forecast at the Spring Statement in March.

The overshoot in the Chancellor’s chosen fiscal mandate of the current budget is even greater, at £13.0bn. It would now take a big turnaround over the remainder of the year to put borrowing in 2025/26 back on track to meet the OBR’s forecast

There is one piece of good news for the UK government in today’s public finances – the ONS has revised down its estimate of borrowing in the first five months of the financial year by £4.2bn.

PwC: Reeves's fiscal headroom is “all but exhausted”.

Nabil Taleb, economist at PwC UK, fears that Rachel Reeves’s fiscal headroom is “all but exhausted”.

That would leave the chancellor with an unpalatable list of options – either raise taxes (potentially breaking a manifesto pledge), cut spending (and possible face a rebellion from her colleagues), or allow borrowing to rise even higher than planned (thus breaching her fiscal rules).

Following this morning’s news that the UK has borrowed almost £100bn since April, £7bn more than Britain’s fiscal watchdog, the OBR, had forecast, Taleb explains:

“Public sector net borrowing totalled £20.2bn in September 2025, 8.6% more than in the same month last year and the second-highest September figure since records began, surpassed only by the deficit in September 2020 during the peak of the Covid pandemic.

“Debt interest payments reached £9.7bn in September, £3.9bn more than a year ago. The interest payable on central government debt was higher than any previous September on record. Higher debt servicing costs as a share of total revenues will leave the public finances more exposed to future economic shocks.

“The Chancellor faces an increasingly difficult balancing act ahead of the Autumn Budget, with her fiscal headroom all but exhausted by a mix of weaker growth prospects, higher borrowing costs and rising spending pressures. An expected downgrade to the OBR’s long-term growth forecasts will only add to the squeeze. Despite ruling out another £40bn tax grab, fresh tax rises and spending cuts now look unavoidable as she tries to rebuild her £10bn buffer. The IFS estimates she’ll need to find around £22 billion to do so.

Tax take rose in September

Tax receipts rose last month, partly thanks to Rachel Reeves’s decision to raise taxes on businesses, but it wasn’t enough to bring the deficit down.

Today’s public finances report shows that central government’s current receipts rose by £6.8bn in September to £86.2bn.

That was partly due to a £3.2bn increase in compulsory social contributions, to £16.9bn, following the increase in employers’ national insurance contributions in April.

There were also increases of £1.3bn in Income Tax, £1.0bn in Value Added Tax and £700m in Corporation Tax receipts.

UK borrowed £20.2bn in September

In September alone, UK borrowing rose to £20.2bn, as the public sector spent more than it received in taxes and other income last month.

That’s £1.6bn more than in September 2024 and the highest September borrowing since 2020.

Nearly half of that deficit was due to the cost of servicing the existing national debt, after a rise in inflation pushed up the interest bill.

The ONS explains:

central government debt interest payable increased by £3.8bn to £9.7bn, with movements in the Retail Prices Index (RPI) adding volatility to the monthly debt interest costs.

Today’s public finances also show:

-

central government departmental spending on goods and services increased by £2.6bn to £38.3bn, as pay rises and inflation increased running costs

-

net social benefits paid by central government increased by £2.0bn to £27.5bn, largely caused by inflation-linked increases in many benefits and earnings-linked increases to State Pension payments

-

payments to support the day-to-day running of local government decreased by £1.1bn to £10.0bn; these intra-government transfers are both central government spending and a local government receipt, so they have no effect on overall public sector borrowing

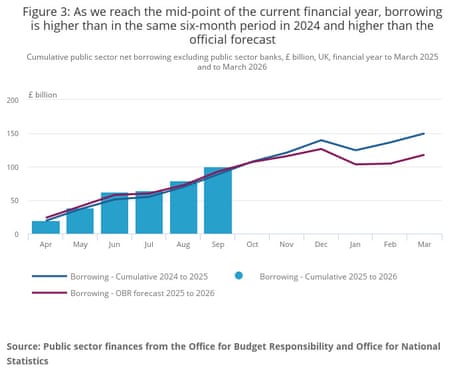

UK borrowing this financial year is highest since 2020

Newsflash: UK government borrowing has hit its highest level since the Covid-19 pandemic in the first half of this tax year, eating into chancellor Rachel Reeves’s headroom.

The Office for National Statistics has reported that the government has borrowed £99.8bn so far this finanical year – which is £11.5bn more than in April-September 2024.

That’s the second-highest April to September borrowing since monthly records began in 1993, after that of 2020.

The problem for Reeves is that this is £7.2bn more than the £92.6bn forecast by the Office for Budget Responsibility back in March. That shortfall creates pressure on the chancellor to raise taxes or cut spending to keep within her fiscal rules (to have debt falling in five years time).

Martin Beck, chief economist at WPI Strategy, says there is little relief for the Chancellor as borrowing remains stubbornly high. adding:

“As things stand, total borrowing in 2025–26 could overshoot the OBR’s full-year forecast by around £10bn, pushing the deficit to close to 5% of GDP.

That’s uncomfortably large for an economy operating near full employment and long past the shocks of the pandemic and energy crisis.

Still, the public sector’s sizeable deficit is partly a mirror image of the large financial surplus being run by households, and therefore not wholly within the government’s control.

AWS outage offers some a brief glimpse of a tech-free existence

Eva Corlett

Workers were sent home, exams were delayed, coffee machines had to be turned on manually and language app users feared their hard-won progress was lost as a result of the global outage of Amazon Web Services on Monday, as some made light of their briefly tech-free existence.

A glitch in the AWS cloud computing service brought down apps and websites for millions of users around the world affecting more than 2,000 companies, including Snapchat, Roblox, Signal and language app Duolingo as well as a host of Amazon-owned operations.

But amid the chaos affecting vital services around the world, some more unexpected consequences arose.

Amazon workers posted videos of themselves on TikTok relishing a slower work day, with some dancing in quiet warehouses, while others told CNN they had been sent home.

James from Texas told the network:

“Working for Amazon Flex we’ve been sent home due to their systems not being able to check us in or release us with pay. Because of this outage there’s no telling if the 80 of us here are going to be paid.”

Amazon says AWS cloud service is back to normal

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

The worst disruption to hit the internet in over a year appears to be over.

Amazon has declared that its cloud service has returned to normal operations, ending an outage that brought down thousands of sites annd many popular apps, including Snapchat, Duolingo, Fortnite and Reddit.

At around midnight UK time, Amazon Web Services declared that its services were fully recovered, after its operations in the North Virginia region were hit by increased error rates and latencies, with a knock-on impact on other regions.

Amazon did caution that some services still had a backlog of messages that they will finish processing, and promised to share a “detailed AWS post-event summary.”

The outage – the largest since CrowdStrike’s glitch in 2024 – has highlighted the vulnerability of the world’s interconnected technologies, and the perils of relying on relatively few massive tech companies.

Dr Corinne Cath-Speth, the head of digital at human rights organisation Article 19, said:

“We urgently need diversification in cloud computing. The infrastructure underpinning democratic discourse, independent journalism and secure communications cannot be dependent on a handful of companies.”

Cori Crider, the executive director of the Future of Technology Institute, a thinktank that supports a sovereign technology framework for Europe, said:

“The UK can’t keep leaving its critical infrastructure at the mercy of US tech giants. With Amazon Web Services down, we’ve seen the lights go out across the modern economy – from banking to communications.”

The agenda

-

7am BST: UK public finances for September

-

9.55am BST: Chancellor Rachel Reeves to speak at a regional investment summit in Birmingham

-

11.30am BST: Bank of England’s Andrew Bailey and Sarah Breeden testify to Lords Financial Services Regulation Committee

2 months ago

67

2 months ago

67