Introduction: Opec+ to pause oil output rises next year

Jillian Ambrose

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

The oil price is rising after the world’s biggest oil producers agreed to pause their planned oil production hikes in the first months of next year, to assuage fears that the global market may become oversupplied with crude.

At a meeting of the Organization of Petroleum Exporting Countries (Opec) and its allies on Sunday, led by Saudi Arabia and Russia, energy ministers agreed to nudge the cartel’s exports up by 137,000 barrels a day in December, before halting any further rises in January, February and March.

The decision marks a change of policy from the eight-strong group which has increased its production quota by almost 3m barrels of crude a day over the past year. The group has opted to slow its growth in recent months to avoid a collapse in oil prices amid growing concerns of a market oversupply.

“OPEC+ is blinking — but it’s a calculated blink,” said Jorge Leon from Rystad, adding:

“Sanctions on Russian producers have injected a new layer of uncertainty into supply forecasts, and the group knows that overproducing now could backfire later.”

This morning, Brent crude has gained 0.75% to $65.25 per barrel, with US crude up a similar amount to $61.44 per barrel.

Oil prices fell to a five-month low of about $60 a barrel on 20 October on concerns that a glut was building in the market - but prices then recovered following a raft of sanctions against Russian oil barrels and a thawing of trade relations between the US and China.

The agenda

-

9am GMT: Eurozone manufacturing PMI for October

-

9.30am GMT: UK manufacturing PMI for October

-

9.30am GMT: UK public sector productivity statistics

-

2.45pm GMT: US manufacturing PMI for October

Key events Show key events only Please turn on JavaScript to use this feature

The UK stock market has started the new week slightly stronger, with the FTSE 100 index up 12 points or 0.13% at 9730 points.

Legal & General (+1.4%) and Standard Chartered (+1.6%) are leading the risers, along with BP (now +1.5%).

Shares in oil giants are rising in early trading in London, after Opec+ paused its plans to hike output in the early months of 2026.

BP are among the top risers on the FTSE 100 share index, up 1.75%, after announcing the sale of its non-controlling stakes in the Permian and Eagle Ford midstream assets of its U.S. onshore oil and gas business for $1.5bn.

Shell’s shares are up 1%, supported by target price upgrades from Berenberg and Citigroup this morning.

The United Arab Emirates’ energy minister has predicted that growth in AI data centres will lift oil demand in 2026.

Asked about the possibility of an oil glut in 2026, at the ADIPEC energy conference in Abu Dhabi, Suhail al-Mazrouei repled:

“I think all of what we are seeing is more demand.”

Mazrouei pointed out that energy investments are needed because artificial intelligence and data centres require more power, pointing out (via Reuters):

“There is a requirement for more energy ... and we need to make sure the environment for investment is allowed to do that.

“If we’re not achieving a balance between the price and what you would require, we will not have (a sufficient flow of investment) to do it.”

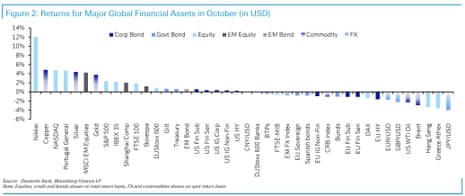

October was another strong month for markets, thanks to the US-China trade truce, strong economic data and decent earnings releases.

Those positive factors outweighed concerns around private credit and fears of a potential AI bubble, explain Deutsche Bank’ analysts Henry Allen and Jim Reid.

They point out that the S&P 500 share index posted a 6th consecutive monthly gain for the first time since 2021, adding:

Meanwhile in Japan, the Nikkei had its strongest month since October 1990 as the new government led by Sanae Takaichi came to office.

In fixed income, sovereign bonds advanced despite the Fed’s hawkishness towards month end, with the 10yr Treasury yield (-7.3bps) seeing its lowest monthly close in over a year, at 4.08%.

And finally, precious metals had another good month, with gold moving above $4,000/oz for the first time, whilst silver posted a 6th consecutive monthly gain for the first time since 1980.

Asia-Pacific stock markets are climbing this morning, amid ongoing relief over the US-China trade deal agreed last week.

China’s CSI 300 index has gained 0.3%, while the Hong Kong Hang Seng index is up 1%, and South Korea’s KOSPI 200 has surged 3.4%.

The White House released a fact sheet on Saturday with more details about the trade agreement which was agreed between President Trump and China’s President Xi Jinping in South Korea.

It says China has agreed to:

-

Halt the flow of precursors used to make fentanyl into the United States.

-

Effectively eliminate China’s current and proposed export controls on rare earth elements and other critical minerals.

-

End Chinese retaliation against U.S. semiconductor manufacturers and other major U.S. companies.

-

Open China’s market to U.S. soybeans and other agricultural exports.

Tax rises and drop in investment predicted to limit UK growth

Phillip Inman

The prospect of looming tax rises and a fall in business investment will restrict the UK’s economic growth rate next year to less than 1%, according to a health check of the economy by a leading consultancy this morning.

With less than four weeks before Rachel Reeves delivers her budget on 26 November, the EY Item Club has downgraded Britain’s growth for next year, indicating that the economy will continue to expand at a sluggish pace, limiting tax receipts and the chancellor’s financial room for manoeuvre.

Morgan Stanley raises oil price forecast after OPEC+ pauses output hikes

Morgan Stanley has raised its near-term forecast for crude oil prices following OPEC+’s decision to pause production hikes.

The Wall Street bank said on Monday it was lifting its Brent estimate to $60 a barrel for the first half of 2026, up from $57.50, Bloomberg reports, after Opec and its allies said yesterday they plan to halt output increases in the first quarter of next year.

Morgan Stanley analysts explained:

“Even if the OPEC announcement does not change the mechanics of our production outlook, it does send an important signal.

“With OPEC involvement, volatility is reduced.”

Introduction: Opec+ to pause oil output rises next year

Jillian Ambrose

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

The oil price is rising after the world’s biggest oil producers agreed to pause their planned oil production hikes in the first months of next year, to assuage fears that the global market may become oversupplied with crude.

At a meeting of the Organization of Petroleum Exporting Countries (Opec) and its allies on Sunday, led by Saudi Arabia and Russia, energy ministers agreed to nudge the cartel’s exports up by 137,000 barrels a day in December, before halting any further rises in January, February and March.

The decision marks a change of policy from the eight-strong group which has increased its production quota by almost 3m barrels of crude a day over the past year. The group has opted to slow its growth in recent months to avoid a collapse in oil prices amid growing concerns of a market oversupply.

“OPEC+ is blinking — but it’s a calculated blink,” said Jorge Leon from Rystad, adding:

“Sanctions on Russian producers have injected a new layer of uncertainty into supply forecasts, and the group knows that overproducing now could backfire later.”

This morning, Brent crude has gained 0.75% to $65.25 per barrel, with US crude up a similar amount to $61.44 per barrel.

Oil prices fell to a five-month low of about $60 a barrel on 20 October on concerns that a glut was building in the market - but prices then recovered following a raft of sanctions against Russian oil barrels and a thawing of trade relations between the US and China.

The agenda

-

9am GMT: Eurozone manufacturing PMI for October

-

9.30am GMT: UK manufacturing PMI for October

-

9.30am GMT: UK public sector productivity statistics

-

2.45pm GMT: US manufacturing PMI for October

1 month ago

35

1 month ago

35