The All Bar One owner, Mitchells & Butlers, has warned that it is facing about £130m in extra costs over the next year because of a soaring wage bill and rising food prices.

The group, which also owns brands including Toby Carvery, Harvester and Miller & Carter, said the cost increases were largely being driven by April’s increases to the minimum wage and employers’ national insurance contributions.

The company also said it was facing increases in food costs, particularly for meat.

The additional bill also includes a “preliminary assessment” of the impact of Wednesday’s budget, which included an above-inflation rise in the minimum wage from April. The national living wage will rise to £12.71 from April for over-21s. The minimum wage for 18- to 20-year-olds will increase by 8.5% to £10.85 an hour.

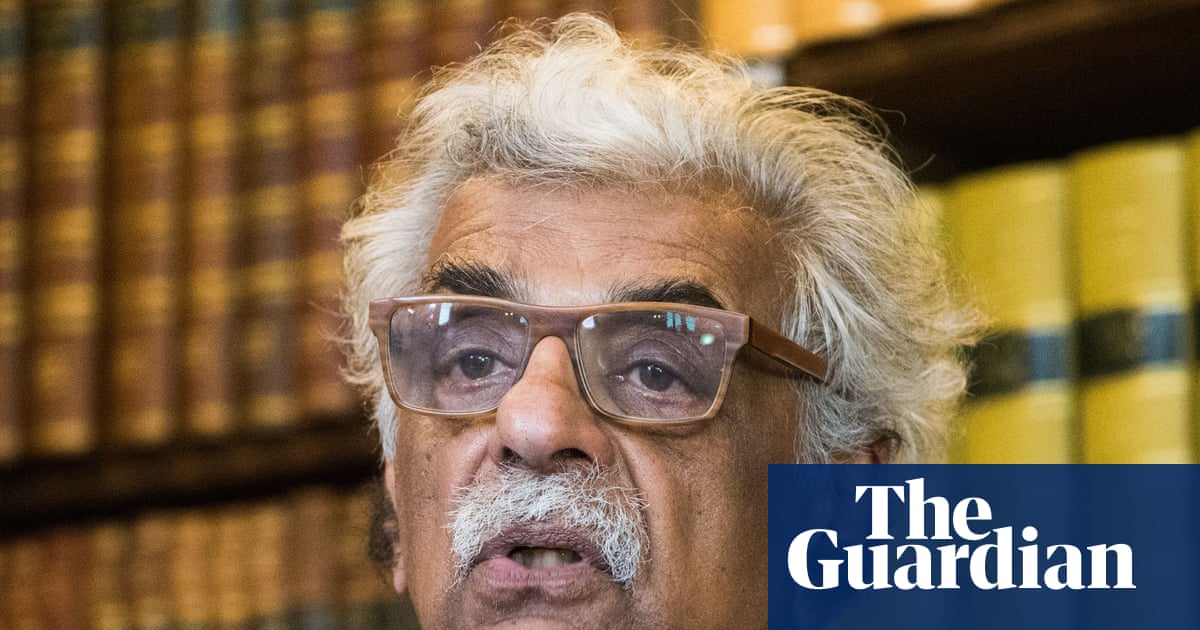

“As we look to the year ahead, we anticipate increased cost pressures across the sector,” said Phil Urban, the chief executive of M&B. “However, we remain confident in our ability to manage these challenges.”

The £130m hit to its cost base failed to dent investor confidence as M&B’s shares soared more than 10%, the fastest rise on the FTSE 250 index of medium-sized listed companies, as the group produced a strong set of full-year results.

M&B reported revenues of £2.7bn for the year to 27 September, up from £2.61bn in 2024, and a 20% year-on-year increase in pre-tax profits to £238m.

Food and drink sales rose 4.3% year on year, and at 3.8% in the first eight weeks of the company’s new financial year, ahead of the rate in the run-up to Christmas last year.

Separately, shares in the Premier Inn owner, Whitbread, slumped more than 5% after a double downgrade in the recommendation to clients to underperform by analysts at Bernstein.

The analyst Richard Clarke said the impact of business rate changes in the budget was a “hammer blow” to Whitbread.

Bernstein examined a sample of 67 Premier Inn hotels and found the median increase in the rateable value of its properties to be about 174%, with most of its estate above the £500,000 level meaning no relief.

after newsletter promotion

As an example, Bernstein cited the Manchester Piccadilly Premier Inn, where there will be a 385% increase in its rateable value.

Bernstein estimates the overall impact on pre-tax profits to be up to £30m in the first year, £90m in the second year and £140m in year three.

Analysts at Citi also downgraded Whitbread, estimating that about 110 of its hotels would be affected by the upward revaluation of the rateable value per hotel. Its estimate put the cost to the company at about £43m a year.

“We expect Whitbread to look to offset some of this increase through cost-cutting measures,” the Citi analyst Leo Carrington said. “Equally, given that all big-box hotels will be facing similar property-level cost increases, we might expect that industry pricing can increase to offset the higher rates. That said, we expect investors to view this as an unmitigable cost.”

Citi estimates that by 2029, when the full impact stabilises, it will result in a decrease of about 5% in adjusted profits at Whitbread, which also owns the Beefeater and Brewers Fayre brands.

2 months ago

62

2 months ago

62