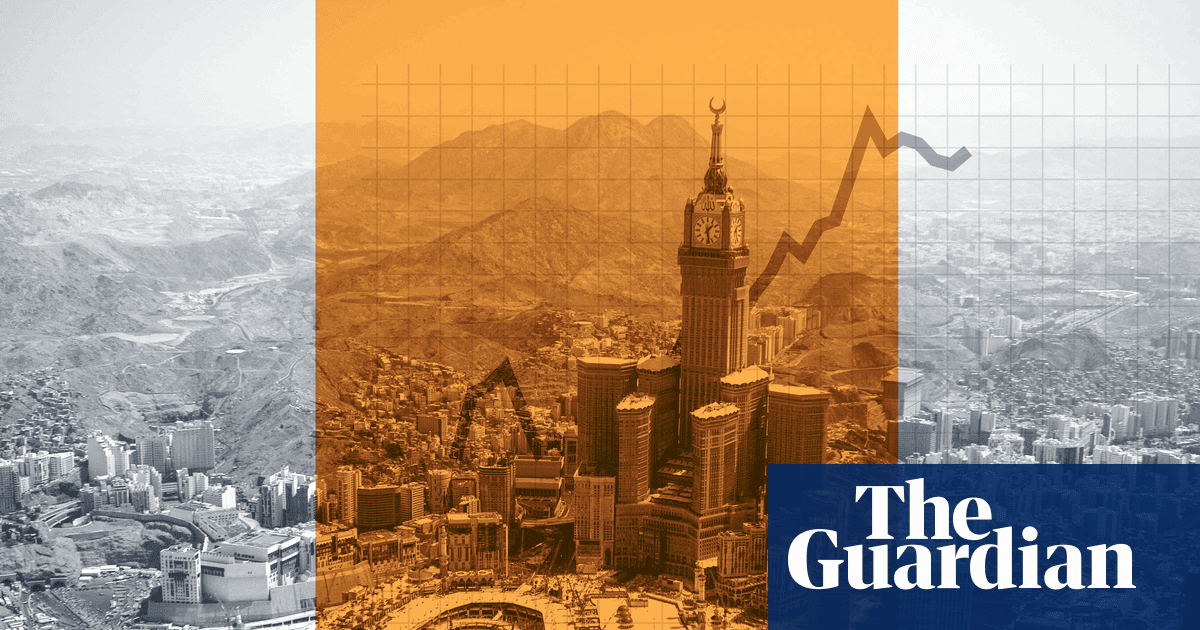

There are less than three weeks to go. In the lengthy wait for Rachel Reeves’s autumn budget, the chancellor will on Monday get the first verdict on her tax and spending plans from the Office for Budget Responsibility (OBR).

After the interminable weeks of speculation, kite flying and bad headlines, this moment matters. Has the widely anticipated fiscal gap of up to £30bn been filled? At what cost for growth, inflation, and living standards?

Heading into this moment the chancellor can take some heart. Gilt markets have rallied in recent weeks, bringing down the cost of government borrowing. What the OBR thinks is one thing. But the bond market is the intimidator-in-chief of governments the world over.

The backdrop in global markets has helped in recent weeks. Falling US borrowing costs are a tailwind. Reeves has also succeeded in rolling the pitch for jittery investors in UK government debt by talking-up her commitment to fiscal discipline. The negative space framing the chancellor’s otherwise vacuous speech last week was the acknowledgment that taxes will rise, spending could be cut.

Keeping the bond market on side is important. There are plenty of voices arguing the dangers are overplayed. But Reeves is right to say there is “nothing progressive, nothing Labour” about risking a bond-market reaction that would drive up borrowing costs. However, there is a fine line to tread. Bending to the bond market view is no risk-free bet.

In the City, investors are looking for Reeves to be tough on public spending in particular. Doing so would send out the strongest message of budget discipline to the bond market – far more than a manifesto-busting round of tax hikes.

As debt market analysts at Barclays put it last month: “Spending reform is now seen as a totemic issue by the market.” That Keir Starmer’s government foundered in its attempt to cut £5bn from welfare earlier this year was “a red flag from the perspective of the gilt market,” they said.

At the same time, bond investors worry big tax increases could torpedo Britain’s growth prospects. Doing so would lock the country in a debt-laden, low-growth doom loop.

“The gilt market can see the more you’re sticking up taxes, the more that you’re trashing growth,” says Mark Dowding, the chief investment officer at the hedge fund RBC BlueBay. He would rather Reeves prevent a “culture of benefits dependency” from taking root by cutting welfare.

“The tax burden is already historically high, and if spending continues to move on an upwards trajectory, you’re almost saying that taxes will need to continue to increase. That doesn’t feel sustainable.”

Reeves will need to be alive to the risk that tax rises could hit growth – the government’s No1 mission. The Bank of England could take some of the slack by cutting rates. But it is a gamble. A slowdown would sap tax receipts, living standards. Efforts to balance the books and Labour’s re-election chances would take a serious knock.

However, the welfare-cutting bias in the City is simplistic, misplaced, and could condemn Britain to a worse trajectory.”

Cutting welfare might sound an attractive cost saver. Total spending in cash terms is rising at a dramatic rate: from roughly £300bn to about £370bn by the end of the decade – largely as a result of the pensions triple lock and rising disability and health-related benefit caseloads.

Britain is an ageing and increasingly unwell nation, fuelled not just by simple demographic changes; but also an underperforming economy and crumbling public services. A fifth of the population is of retirement age, and as life expectancy increases and the baby boomer generation reaches older age, these changes will only accelerate. The welfare bill is a reflection of this.

after newsletter promotion

At any one time, the state makes benefit and pension payments to more than 24 million people. Pensioners get most of the money, with 13.1 million recipients. Much of the rest goes to 10 million working-age adults, most through universal credit – where more than a third of claimants are in work.

Despite these pressures, total welfare spending is projected to remain flat as a percentage of GDP up to the end of the decade. Tell this to the next person who says welfare spending is on an unsustainable path but holding the defence budget constant as a share of national income is a disaster.

For all of the pressure on the state, overall working-age welfare spending is flat and similar to the levels in 2015. Cash spending on health-related benefits is rising, but as a share of GDP it is lower now than in the 1990s.

When push comes to shove, welfare cuts affect more people than might be immediately imagined in the othering narratives about welfare scroungers. Evidence shows health-related benefit cuts would drive up poverty, not employment. Meanwhile, taking money out of the pockets of vulnerable people would reduce spending in the economy. Raising taxes is not the only way to slow an economy to stall speed.

Increasingly, there is recognition that Britain’s economic prospects have been undermined by the erosion of the country’s social safety net.

The debate at the last election was centred on boosting growth to fund public services and the welfare state. But this negates the point that the relationship between the two is symbiotic. The last decade and a half of austerity is proof enough.

3 months ago

116

3 months ago

116